Hello everyone, today's article is about sharing my experience about investing in Cryptocurrency from A - Z.

In this article, I will try to write as fully and detailedly as possible so that newcomers will have an overview, avoid encountering pitfalls as well as avoid falling into my own mistakes. Every car accident costs money, so the more you avoid it, the more money you'll save.

*Note: I want everything to be strong in this article so that everyone can follow it, even new friends. I will also conveniently update it later. Therefore, I will not divide the parts into smaller parts like usual, so it will be very long, so please bear with me.

Hopefully through this article, 4.5 years from now, the quality of life of all of us will jump to a new level.

LET'S START

When investing in coins, the most important thing is to combine the following 3 skills:

- Technical analysis.

- Fundamental analysis.

- Capital Mangement

In there:

- Fundamental analysis is a technique used to find and select potential coins with future development and good profitability to choose to invest money in, in addition to analyzing cash flow and trends. of the market (not through the chart)

- Technical analysis is a technique used to find reasonable buying and selling points when choosing a potential coin.

- Finally, capital management is the most important thing. It helps us survive in harsh financial markets when we are wrong. Because surely no one can be right.

Now let's go into more detail about each part!

I. Fundamental analysis

Let's talk about fundamental analysis first because this is the thing I talk about the least but it is a quite important part.

- If you are an investor who is afraid of learning about technology, has the ability to eat reliably, doesn't like complexity, and generally just wants to invest in the crypto market because it is the future and has good growth potential, then go ahead. Investing in Bitcoin and ignoring this fundamental analysis factor is fine.

- And if you are an investor who determines that the crypto market is a place to seriously invest and be with it for the long term, then seriously read and learn about it the way real estate investors read and learn about projects and houses. Stock investment tracks, reads and studies financial reports. I believe this is a very potential market, worth your time to learn about it.

- Reading fundamental analysis will help us know more about upcoming technology trends in the market. For example, the trend of the years 2020 - 2021 will be Layer 1 platform coins with the purpose of competing with Ethereum. But 2023 - 2024 will probably be Layer 2, LSD, Gamefi,... because Ethereum has proven its strength and built a leading solid ecosystem that is difficult to overthrow.

Ok, so now that you've decided to seriously learn about the cryptocurrency market, where should you start first?

1. For people who don't know anything about Crypto

If you don't know anything, first learn about the mechanism of blockchain and how it operates to understand what problems and problems it can solve in life. There are very easy to understand and intuitive explanation videos on YouTube that you can watch.

There are a few videos I found that are quite good that you can refer to (All have Vietnamese subtitles, please edit before watching)

The purpose of learning this is not to understand too deeply because for most people, it is quite difficult to understand deeply, the purpose is to understand the core nature of things called cryptocurrencies and electronic money. From there, having the right view, understanding it will create trust, only when you have trust can you invest money the same way we spend a lot of money to buy real estate or gold.

If you don't understand or have confidence, investing in cryptocurrency is just like "playing". "Playing" as people often say is playing stocks, playing forex, playing coins. But for real estate and gold, it's all about real estate investment and gold investment.

In short, when you don't know anything, learn from the core things first to gain confidence before you can seriously accompany and invest in this market. This is very, very important, so don't underestimate it. You must have faith in the market so you can overcome storms and FUD waves.

2. For people who know about Crypto

If you are someone who already knows and wants to start seriously learning about this market, the next step is to read, read a lot. At first, it will be a bit overwhelming with information and terminology, but starting to learn anything is the same.

- Read from basic content for newbies, how to buy and sell cryptocurrency, exchanges, terms.

- Read on to ecosystems.

- After reading the ecosystem, read the applications in the ecosystem (dApp)

2.1. The ecosystem in Crypto is very important.

If you compare the ecosystem in Crypto with things that everyone knows, it can be compared to the ecosystems of Apple and Samsung.

To use an analogy, there are many technology companies and technology corporations in the world, and each corporation tries to create its own ecosystem, but among all of them, Apple's ecosystem is and Samsung is the most famous, powerful and has the most users. And it's the same in coins. So read, research and learn about it first.

2.2. Applications in the ecosystem

After learning about the ecosystems, learn about the applications in each ecosystem. People and the press often call this trends. These trends can only be short-term trends that will disappear in the future, but they can also create a new future or change forever. the future of some current professions. The best applications are often deployed first in strong ecosystems. Read, research and make your own informed judgment.

And to make it easier for those who don't know, I can compare it with things that everyone knows. That is the "trend" of removing the 3.5 headphone jack port along with making true wireless headphones instead of wired headphones that technology companies compete with in the past and is still the same today. It has changed the headphone industry and the way people used wired headphones before. And companies that design wireless headphones must do so in a way that is compatible with the first strong ecosystems such as iOS or Android.

3. Where to see information about Crypto?

Initially, I recommend reading here https://coin98.net/.

In Vietnam, I consider this to be one of the websites with detailed writing, clear web design layout, easy to follow, and easy to learn for newbies. And you can also see more on other websites as well as on Youtube.

Everyone should note that this coin98.net is Coin98 Insights (sharing information channel) and coin98.com is the Wallet and coin conversion portal. I say reading information at coin98.net does not mean advising you to use Coin98 wallet or buy C98 coin. Because I have tried it myself, but the C98 platform still has many limitations.

But there is one thing I want to warn you about in advance. That is, when reading articles on websites or watching videos on Youtube evaluating project potential, after reading or watching, beginners will feel that every project has potential, no matter which project it is. Can also invest.

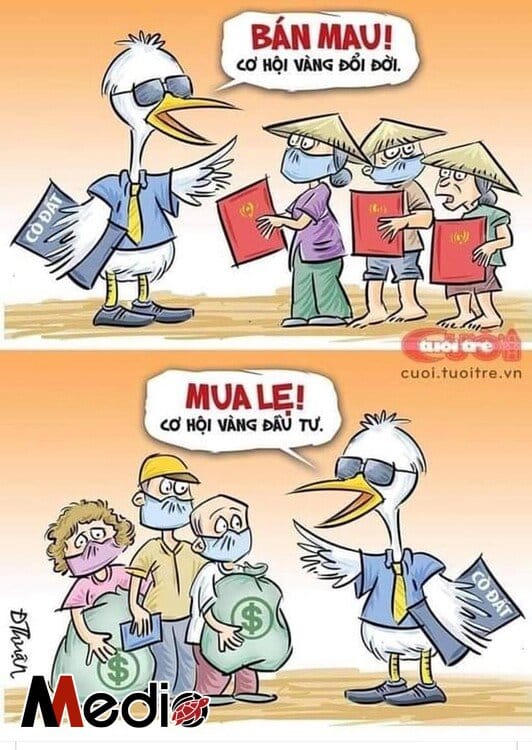

This is one of the very dangerous points for newbies. It's no different than when you go to buy land and only hear real estate brokers talk about the land's potential and upcoming projects in the area. It's too rosy and that's not good at all.

So when reading and watching videos about coin and token reviews. People say that no matter how good the development potential is, just leave it there for now, don't ignore it. Watching the evaluation is to understand what the mission of that coin is, what problem that coin solves, how that coin's project is operating to compare with other coins and then rate it. My price is because on a website or a youtube channel, I can review and talk about dozens of projects and of course only a few of them have a future.

Therefore, if you want to invest properly, read carefully and study and filter projects. Just read through, read around once to get an overview of what the market is like before choosing a coin and then researching that coin more closely to see if it really has a future or not.

I don't introduce any project, but I have a few small experiences, some of which I had to exchange with a bunch of stupid money that I want to share, hoping it will help everyone find, filter and choose. Potential coin.

In addition, I often follow projects on Twitter and KOLs that I find suitable for my investment style. Sometimes there are a few people I follow because I want to see and read through the comments to see what the current crowd trend is (however, this is also a double-edged sword, it can also cause you to suffer from FOMO).

3.1. Experience 1: If you don't know, you should choose the safe option

If you don't have much experience and want to invest safely, in addition to Bitcoin, choose large platform coins, coins that already have strong ecosystems such as ETH, BNB...

3.2. Experience 2: Top is mostly good

If investing by field, you should choose the top coin in the field you want to invest in.

Meaning: Like before, if you want to invest in exchange coins, choose coins from top exchanges. If you want to invest in Defi, you also choose the top, if you want to invest in Gamefi, you also choose the top... Although that is said, investing in the top coin is not always the best, it still has risks but at least it minimizes the risk a lot.

This is also one of the painful lessons I learned from losing money in the past, when I first started investing in coins.

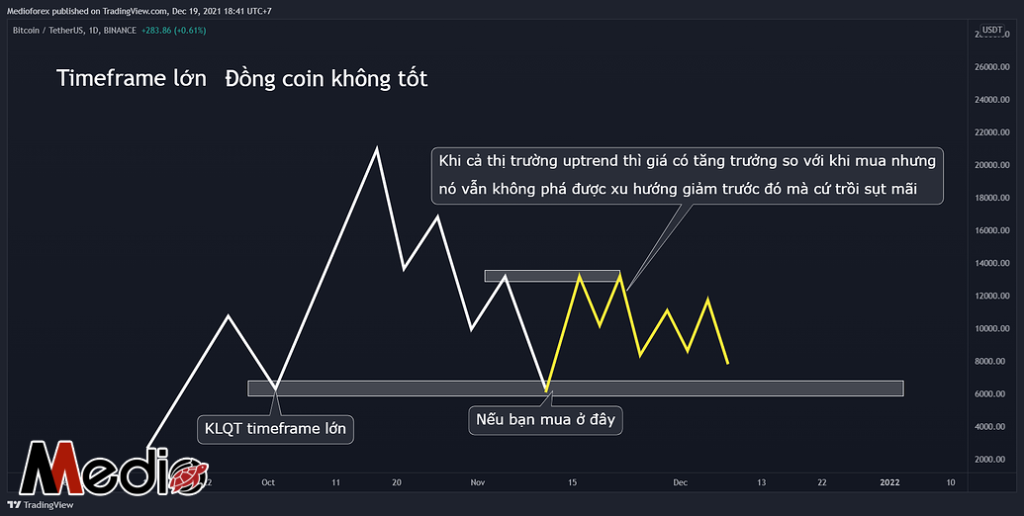

At that time, the market also had its trends. I decided to choose to invest according to a trend at that time. But instead of choosing the coin with the best capitalization, the best community, and the most stable operation in that trend, I chose the bottom coin, which is much more humble. The reason I chose that is because I see that the top coin in that trend already has a large market capitalization, so I assess the possibility of the account growing x many times is not high. Choosing the bottom coin in that trend has a small capitalization, the ability to give x many times the account is higher, so I made that choice.

And that was a big mistake from my distorted thinking at that time. Although the precious gem already has a high value, it becomes brighter and brighter each day, increasing in value. Garbage has low value, but as it rots, its value decreases.

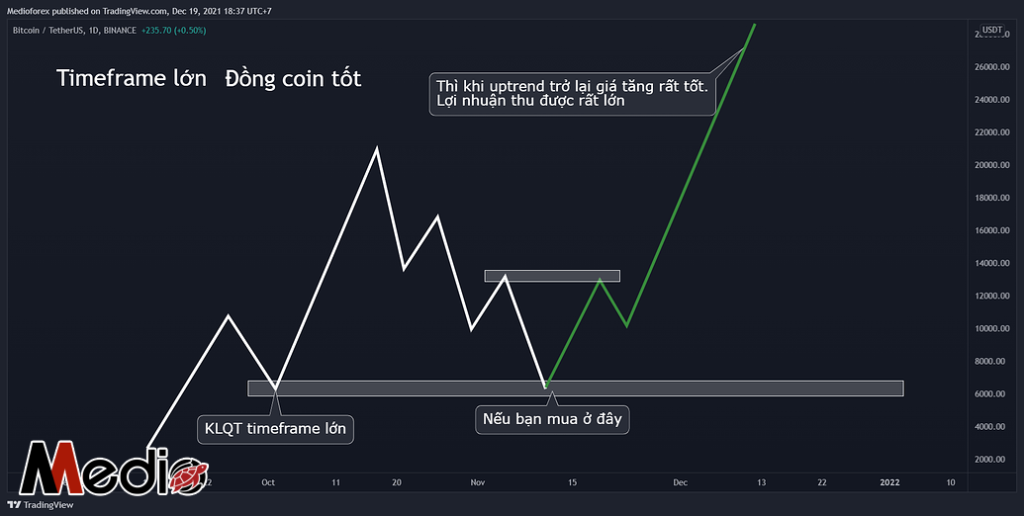

Apple has a sky-high capitalization and is at the top of the stock market, but its capitalization is increasing, in 2020 it increased by 80% in capitalization value. Bitcoin's capitalization is also at the top of the digital currency market but still grew to 2000% compared to the bottom of the previous downtrend, ETH ranked 2nd also increased terribly, and the junk coins that I bought in the past have cut losses, looking back now. , it has not yet broken the volume of the downtrend and is drifting somewhere on the horizon, so it is not true that every coin will uptrend if the market is uptrend.

This sentence should correctly be:

In an uptrend market, good coins all uptrend

Of course, if you find gems in the trash, the reward will be extremely generous. It's difficult, that's for when you have experience and are better, but when you're just learning and have little experience, you should choose the top coin in the trend you want to invest in. Remember, you still have to evaluate that top coin carefully like any other coin before investing, not just because it is the top coin in that trend and invest right away.

The cryptocurrency market is now much larger than the boom year of 2017, but it is still tiny and the development potential is still huge. So don't worry too much about the capitalization of the coin you choose is large so it doesn't do much, but only care about whether that coin is really good or not, and what its future will be like. If it's good and has potential, then wait for a good price and then "buy".

Fun: Don't invest if you see Tether - USDT is also at the top

3.3. Experience 3: Be careful of coin projects created in Vietnam

During my friend's research process, I rarely invested in coin projects created in Vietnam.

Saying this, this article may be full of criticism, and I may be cursed for not being patriotic or not supporting Vietnamese goods. But when investing, investors only consider profits, losses, and risks, but do not include feelings between men and women or patriotism.

If you buy poor Vietnamese consumer goods, you will rarely be able to use that item, although it is not as good as other products. But if you invest in the wrong project, you can lose a huge amount of money without using anything.

And here are the reasons why I rarely invest in coin projects created in Vietnam:

First: It comes from the Founder team.

I'm not talking about technical elements in programming because this is not something that makes it difficult for Vietnamese people. I know many Vietnamese people who are very good. I want to talk about management factors and financial thinking. This is something we are quite weak at.

Not to mention the calculations in the development of the coin: when it is born, when it is used, it helps it keep and increase in value over time for investors (see this in the roadmap), even when the project is still small. It hasn't had many problems in management yet, but when it gets a little bigger, it reveals weaknesses in management, operations, and finance.

This is something I realize not only in coins but in many other fields as well. Not to mention that as the coin develops more, the Founder is more likely to sell the project, sell some coins to get money (this is often called short closing), causing the coin holding rate to decrease somewhat. project development motivation.

So many projects in Vietnam are in a state of elephant head and mouse tail. When they debuted, they were spectacular and explosive, but they gradually faded away and disappeared.

That's what I'm talking about projects with real potential. There are many clone and scam projects in Vietnam. Even when I did MMO or Marketing before, instead of developing in depth, they developed in breadth until the market was "broken".

Especially with the current Play to Earn game trend, you will see dozens of cloned projects that do not bring much value.

Second: It comes from the vast majority of the Vietnamese community

This is the main reason I rarely choose project coins born in Vietnam

For Coins created in Vietnam, the community of that coin is usually mostly Vietnamese and rarely has a foreign community, so the possibility of that coin going to the big sea to grow will also be less and weaker. The community factor is a very important factor that I always consider.

In addition, everyone knows that the number of Vietnamese people with an investment mindset is not high. When a trend starts, the cash flow mainly comes from new people coming in. But the cash flow from new people fomo is cash flow with short-term thinking, surfing thinking. Bought it to wait for its release and then sell it, drop it on the floor so no one else will sell it.

Playing that way, no project can survive. If I were a Founder, I would lose my motivation to develop.

And that's why I rarely invest in projects created in Vietnam. But Vietnamese projects created abroad, or if the Advisor is a foreigner, are still fine because their way of administration is also different, more serious with financial management. In addition, the community has been internationalized, so the ability to hold coins is better, so the ability to grow the project is also higher.

3.4. Experience 4: Tokenomics is an extremely important factor

Unlike Bitcoin or other coins that are created by mining or have a fixed quantity to prevent inflation. Later Crypto coins are mostly in the form of Tokens, so there is no need to mine Proof Of Work like before. So the concept of Tokenomics was born.

Tokenomics is a term made up of two words Tokens (Cryptocurrency) and Economics . Therefore, Tokenomics can be considered the economy of cryptocurrencies, how they are built and applied to the operating model of that project.

A detailed explanation and analysis of Tokenomics would take a long time, so you can read a very detailed article about Tokenomics at: What is Tokenomics? The game is over with the market maker

In addition to the potential factor of the project, Tokenomics is an extremely important factor that you need to analyze because it directly affects the price increase or decrease of the coin in the future.

No matter how much potential a coin has, it cannot increase in price in the future if it is created massively without control, leading to inflation. Or the development team also has no motivation to work if they do not have "enough" benefits,... In addition, it also demonstrates the fairness and decentralization elements required of a Blockchain project.

In short, every project, team, and development potential will have economic factors, so Tokenomics is an extremely important factor. Whether it is the state, company, family, individual... we all have influencing factors such as income, cash flow, spending, savings,... that show whether we can develop sustainably or not?

3.5. Experience 5: The team behind is the "brain" of that coin

The team that created the coin is a huge plus point to the development of that coin

This is a factor that greatly influences me when making a choice. A team of well-known, reputable founders with many previous successful projects always wins the trust of many people. Not to mention that they are reputable, the success rate is higher, but even being reputable has won the trust of many people, so the initial support community is already higher.

Of course, when you first learn, you won't know who is famous and reputable in the market, but after reading for a while you will automatically know. Like, there are many people who don't even know who the current Prime Minister or President of Vietnam is. If you don't believe me, just ask the girls you know who never watch the news or care about politics.

If you don't know, you don't know, that's very normal, but once you do, knowing someone famous and reputable in the community to add confidence in choosing a project is not difficult.

3.6. Experience 6: Community of coins

The coin has a large community which is also a big plus.

This is too clear.

You can find and see if a coin has a large community through that coin's social networking platforms such as Twitter, Reddit, Medium, Telegram, etc. The number of subs or followers is only a part because there will be many followers. Buy subs or followers, interact virtually so you can see more closely the interactions, comments,...

For issues related to the community, because I previously worked in Digital Marketing, I also have an advantage in analyzing other factors such as Website, Traffic,...

For example, with a Play to Earn game project, we can analyze further and what source does the main traffic come from: Google, Facebook,... or where does the traffic come from to know who the project's target audience is and is it potential?

In addition, you can see how often projects post and update progress on social networks, do they take care to develop the community? Because a good project also needs a good media team to make it known to more people before it can take off.

3.7. Experience 7: Cash flow and market trends

- The money flow in the Crypto market will move in different cycles, of course it will not be completely accurate, but according to my experience it will usually be: Bitcoin → Major altcoins in the top 10 → Altcoins in the top 100 → to the tiny top coins further away,…

When the market is at the bottom, capital will pour into BTC because it is the safest, and the price at this time is also very good. After that, the price of BTC will be pulled up and the market will grow accordingly. But when BTC has increased to a certain level, many people see that the price of BTC is high and growth is difficult, so they will switch to lower top altcoins for high profits, etc. Same with the bottom top coins. - In addition, those who see that large coins have increased will tend to look for similar coins but with smaller capitalization to expect higher profits. For example, if ETH increases, it will find other ecosystems such as ADA, Solana, BNB, Fantom,..., Uniswap will increase and will find DEXs (decentralized exchanges) in other ecosystems such as: Pancakeswap , Serum, Spookyswap,…

However, you also have to be very careful with this method of following cash flow trends because if you are greedy and look for projects that are too small with the hope of x10, x20, the risk will be very high, because the project is still too small to bet on. price. Even before the project has been updated, the market has already entered a downtrend. Once the downtrend has entered, big projects that have been verified will continue to develop. But small projects don't know where they will "drift" to.

Summary of fundamental analysis

A good project will be the sum of many factors. The above are just some of my experiences when evaluating. You can only balance the balance of factors, but it is very difficult to have a good project in every detail, because if everything is better, it will be "to the moon".

As I said before, you don't need to go too deep into fundamental analysis to be profitable. The simplest thing is to choose the "top coins" because those are projects that have already been "fundamentally analyzed" by the community for you.

Fundamental analysis will be suitable for those who like to learn about new things, or have "free time" like me.

But this is just one element of the system "Local benefits" but also very important factors "Clement weather" below too.

II. Technical analysis

After going through the basic analysis step to choose potential coins that you can invest in, you don't have to just buy them right away.

I bought it right after reading the project and found it so interesting, so stimulating, so fiery, so potential. That's bad ![]()

Regardless of the potential, it will still be divided by 2, divided by 5, when the market adjusts or divided by 10, divided by 20 when the market goes downtrend.

Fundamental analysis is to choose an investment coin, while technical analysis is to find a reasonable buying and selling point for that chosen coin. This is the factor "Clement weather"!

When it comes to this element of technical analysis, you are no stranger. We have talked a lot on the clubhouse because almost all of the above articles are mainly about technical analysis for trading. So when applying trading techniques to investing, it's like solving a level 1 math problem. There's nothing much to say because it's easy and I've already written other articles about investing. I only have a few notes after that:

- Always analyze Bitcoin/USD first to grasp the current market trend and then analyze the coins you intend to buy later.

- Always look at the large timeframes M,W,D to have a comprehensive, broad view and I also recommend only investing in those timeframes.

Applying technical analysis to find buying and selling points, in addition to increasing investment profits, also helps minimize the risk of choosing a bad coin.

Like choosing a good coin

Buying these coins is great. If you want to be safe and not have too many accounts, invest in Bitcoin and other coins that have a strong platform and ecosystem. If you want to take more risks to earn greater profits, you can invest in riskier coins. This depends on investment taste, each person has their own style, so I have no opinion.

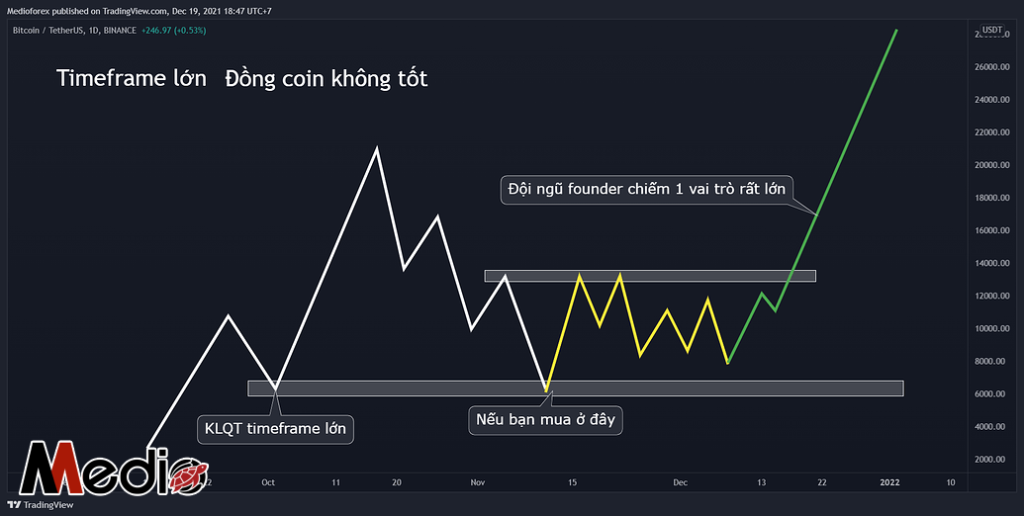

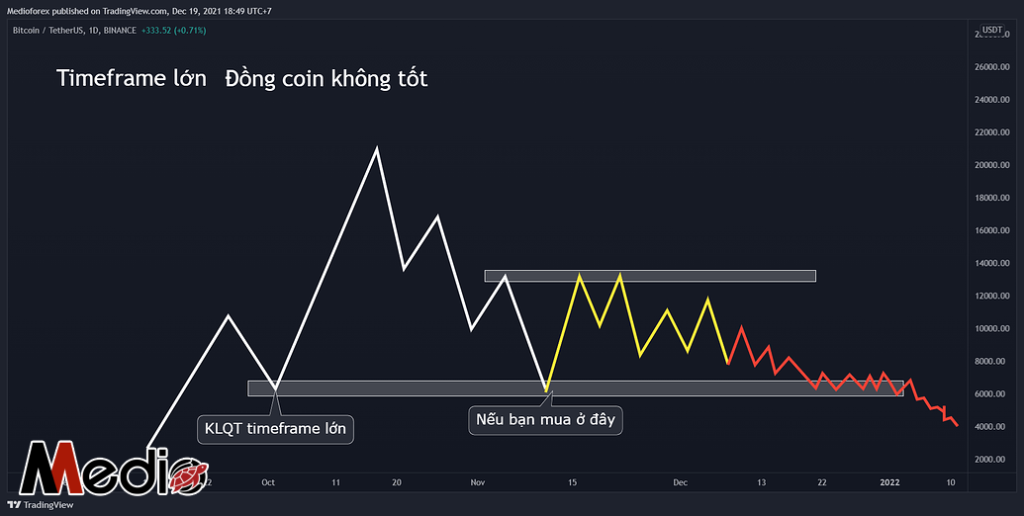

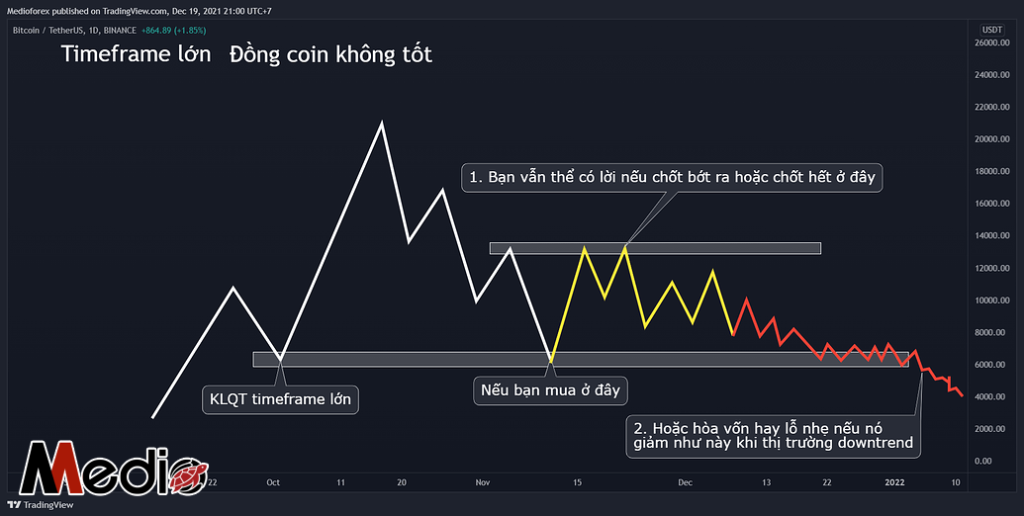

The coin is not good

In the uptrend market, the price has increased but not as strongly as other coins.

If the whole market is still in an uptrend and that coin has major improvements that change in real time (This depends on the founding team factor), then it is very likely that that coin will turn uptrend again.

At this point, it's like finding a gem in the trash. And if the founder team doesn't change, doesn't improve, or doesn't change in time and the whole market moves into a downtrend phase, then decide to cut your losses and forget about that coin.

But even if you are unlucky or unlucky and choose to invest in a bad coin, by using technical analysis, the possibility of loss is greatly reduced, and even still profitable.

But if you mistakenly choose a junk coin, its growth is purely from pumping, then technical analysis will not be of any use here.

III. Capital Mangement.

This is the final boss, the most important, best and most overlooked element and skill. And this is the essence “Human harmony” . I put this factor last not because it is not important, but because this factor is up to you to control, and will be easy or difficult depending on each individual.

Every time Bitcoin drops in price quickly and strongly, in addition to club members and online friends, I am also asked by acquaintances, but the purpose of asking is a little different. People online are afraid that the price will drop sharply and their accounts will be divided into 2 or 3, so they ask me for advice so they can have more confidence to keep, buy more or cut losses. As for acquaintances, most of them only asked if they had suffered a heavy loss ![]()

If I act calm, the people who love me think I'm a pro, and the people who hate me think I'm "trying to act like I'm fine, but inside my tears is a wide ocean". The truth is, I feel really normal and I'm not a pro or acting like a pro here.

The whole secret lies in capital management.

There is a great quote from Mark Cuban: No matter how many mistakes you make, just being right once is enough!.

In that sentence, I don't really like the first part, I only like the second part: Just being right once is enough.

Of course, that's not always true, it's true when we combine it with reasonable and strict capital management, but the more you get it wrong, the more money you'll have until you get it right.

So how does it work in investing?

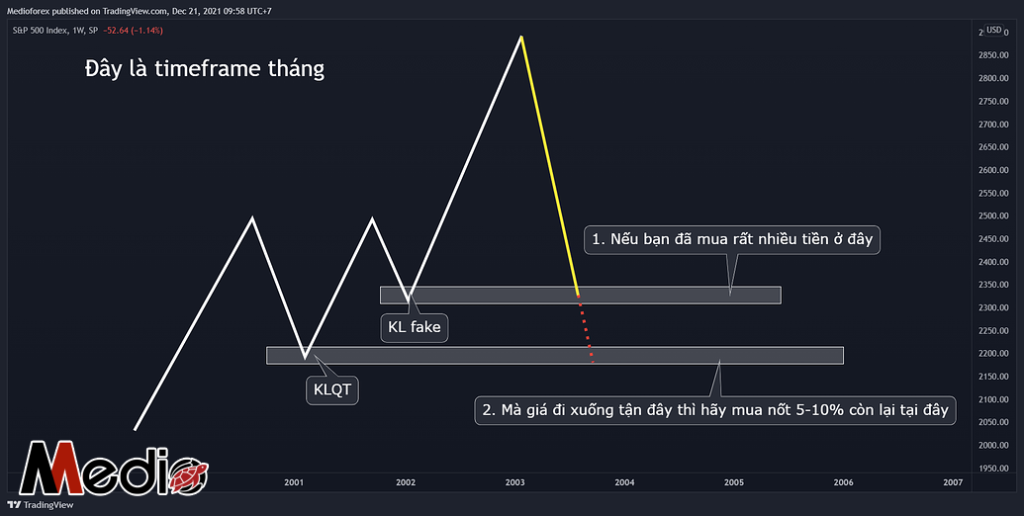

Suppose I predict a coin that I think has potential with:

- Timeframe H4 continues to uptrend, so I invested a sum of money.

- If I am wrong and H4 does not uptrend, then continue to predict that timeframe D will uptrend and I will invest again with a sum of money.

- If I'm wrong again and D doesn't uptrend, then continue to predict that timeframe W will uptrend and I'll continue to invest a sum of money.

- If I continue to be wrong again, W does not uptrend, then timeframe M will uptrend and I will invest another amount of money here.

Every time I make a mistake, I will definitely lose money. The more mistakes I make, the more money I lose. But with just one right time, the previous wrong times will no longer have much meaning, it will make you richer even when you are wrong.

Although I say that, the above things are just examples. In reality, when you have more experience, mistakes will still happen but will not be as many, plus you always need to have some basis to predict any timeframe. uptrend to invest money, not just betting on uptrend randomly and losing capital in vain.

Every time I invest money, I want to invest in the right place, but sometimes I also want to be wrong. It's a bit contradictory, but I want to be right because I don't have to bear the pressure of cutting losses, forcing losses, buying at the right point and having money. I want to be wrong because I know that next time the chance of being right will be much higher and it will bring me even more money.

So when investing, prices increase and profits increase, making me very happy, prices decrease, I don't feel sad because it could be a better opportunity about to open up to increase my assets even faster than when I invested. correct. That is also the main reason for a state of calm in investing. Just 1 time is enough.

And here are some rules and plans for managing my capital in investing in cryptocurrencies and cryptocurrencies at the present time. You can refer to:

Capital management rules

- I only invest a lot of money in the weekly and monthly frames. Especially in the monthly frame. I also invest in H4 and D frames but not much, call it "fun" surfing speculation to make more profit.

- When the whole market trend has been and is still uptrend in the weekly or daily frame, I will be more inclined to invest in Altcoins if the altcoins have not yet strongly uptrend, or I predict the market has not yet entered the downtrend phase. The purpose is to increase profits if I am right, because for me, when it goes uptrend, bitcoin will uptrend first and then it is altcoin's turn, so if the market has been uptrend for a while but it is predicted that it has not yet gone downtrend, then the initial profit will be. Investing in altcoins is better than bitcoin. If it's wrong, cut your losses.

- If the market goes into a downtrend phase and the price drops to a key level in the monthly frame, I will buy safe coins, large coins, platform coins with large ecosystems with larger amounts of money such as Bitcoin, ETH, BNB,... And that is the moment I look forward to the most when investing in cryptocurrency.

At the same time, I will also spend a small amount of money to buy coins that I think have potential.

The reason I do this is because when the trend is down, the price returns to the monthly frame, just by buying large coins, it gives a very good ability to increase assets, most importantly it is safe.

As for me, I bought more coins that I thought had potential with a small amount of money because the coin price at that time was extremely good, the ability to increase assets with a very terrible amount but in return it It's not safe, because not every coin after a downtrend can survive to grow until the next uptrend season, so I only invest a small amount of money in it. At this time, my cash flow is mainly poured into top coins, safe coins.

If you follow the school of high safety, then when there is a downtrend, just find the time to just buy Bitcoin.

Above is the plan I plan to buy and allocate capital at the moment, as for the capital allocation percentage, I also mentioned it in the article. Bitcoin Price Analysis & How I Think in the Coin, Crypto Market 9

However, fixing the number in that article, I think it is a bit rigid because each of us's investment taste and ability to accept risks are different, not to mention the market is not fixed so it is necessary to must be flexible depending on developments at that time. So I think dividing capital as below will be more reasonable.

Capital allocation rules

- When the price returns to the key level tf H4 or tf day (D) and allows you to predict the price will continue to uptrend next that tf, you can invest with a small amount of money from 5 - 20% of your total capital.

Investing 5% is for people who do not like risk, 20% is for people who love adventure. It's like I'm scared to go tubing at a water park, but many people also like skydiving, jet jumping...

In this tf, if I predict the price will continue to increase, I will invest, but I do not encourage new people to invest in this timeframe. Or just invest a small amount of money. - If the price returns to keylevel tf week (W) and you predict the price will still uptrend, you can invest a moderate amount of money from 20% - 60% of your total capital.

The investment amount still depends on your prudence and investment style. Investing a little money in this tf is a cautious person, investing a lot of money in this tf is a person who loves risk. - The price returns to keylevel tf month (M), then you can invest the entire amount of capital that you can invest in this market. But in my opinion, this number should not exceed 90% - 95%. Always leaving 5-10% capital gives you some psychological comfort for the following cases.

Case 1: You can buy exactly the right price range but cannot buy exactly at the bottom of that price range like this

The "Here" times in the photo above are the times when you feel regretful because you couldn't buy at a lower price, or are afraid that the price will continue to drop. That is the normal psychological development of most people. If it happens in a small tf like M5 or M15 timeframe, it is too simple for us, but if it happens in weekly and monthly timeframes, then these things happen. Beards in that large timeframe, if fast, last a few days, longer then several weeks or even months, causing a terrible impact on buyer psychology. Therefore, always leaving 5-10% behind makes me feel calmer because I think I still have money to be able to buy average capital.

You can also call leaving 5-10% in this case as spending money to buy psychological comfort.

Case 2:: If you can't buy exactly the right price range, 5%-10% is the amount of money you can buy at an even more optimal price.

Don't worry too much because a large amount of your money was purchased at a higher price. Because I don't know which tf to swing the peak at, but swinging at the monthly tf, there's nothing to worry about, it's still a very good price, it's just that this time your judgment is a bit off so you don't maximize profits more. Stop.

Buying 5-10% again at a better price range that you did not expect will not only increase your profits but also make you feel somewhat right. A good, comfortable mentality is the key to helping you hold and hold long enough to produce sweet enough fruit.

Investment psychology

Say whatever you want, but when you haven't experienced it, you always feel like following what is in this article is simple, even though it's true that it's simple.

But when you have lost a lot of money and then face times when the price drops sharply, times when the price recovers, times when the sideway price at the place you just bought does not go up immediately, or when all other coins go up and the coin you bought Not everyone can overcome their own psychology until they reach the top.

Some people use their steadfast courage to overcome, some people use their rules to overcome, some people don't look at the chart anymore.

Each person has a different way of controlling their psychology. For me, using money wisely is the best way to control my psychology at the present time. I hope everyone stays mentally stable on the market's waves and manages their money properly In investing, sometimes getting it right once is enough.

Psychological causes and ways to overcome them

Expectations are too great

When we enter the market, we often have too high expectations of x10, x100 or becoming a millionaire in a short time, which will lead to greed and FOMO, fear of missing out on opportunities, so even though the plan is broken, it is still broken.

This expectation is sometimes absent at first, but when you hear about your "friend", "friend", or someone online getting rich quickly, you increase your expectations.

To minimize this, what you can do is: know enough, meditate, limit the use of social networks or hide toxic ingredients.

Scared

This often happens when your fundamental analysis is not good or you just buy because you listen to others but do not clearly understand the coin you are investing in, so when there is bad news or FUD, you immediately get scared. Avoid joining groups or reading too much news, letting the news dominate.

You should also review the chart in the large frame. When doing good technical analysis in the large frame, you will clearly understand whether the market will go up or down and what stage it is currently in in the overall picture.

When you do exactly what I share in this article and at the right point, you will rarely experience this feeling of fear.

Lose patience

It's possible that your capital is not idle capital, so you're in a hurry to make a profit soon. Please stay calm and create a scientific personal financial plan for yourself. Don't let the capital invested in investments affect your life.

The solution to this mentality is:

- Do something to have a monthly income so you can still maintain a normal life and wait for the investment results to grow.

- Focusing on other things like learning a new skill, new knowledge, spending time with family, hobbies will also keep you busy and forget about the chart.

FULL EPISODE SUMMARY

This article is really very long, old friends who are already in the reading market will find it normal, but some new friends may feel "Damned" even though I tried to arrange it in a way that I think is easy to read. closer.

If you really have a flare-up, you can rest assured, after only about 2 weeks of learning, you will stop feeling this way. Because it's actually much easier than trading Forex. After we "overcome" the difficult things, we can move on to the easy ones, which is much easier.

This is my own experience and I will update every time I have new experience?

If you are interested in any topic, please comment and let me know...

It's been a long time since you posted a video on YouTube, I miss your voice so much :D

I said in the videos that I share my experiences, not that I am a teacher, and I don't like being called a teacher.

Bro, if I buy your course now, if I have any questions about the lessons, how can I contact you?

You can discuss at Medio.Cafe Community!

Hi Trung. I'm a newbie who wants to invest in crypto, gold and stocks. Which exchange is the best to open an account on now? Please give me some advice!

For crypto, you can use Binance. As for stocks, I don't participate so I can't advise you.

bạn có thể chỉ giúp mình các trang wets hỗ trợ chechk coin dự án và ,mình là người mới muốn nghiêm túc về thị trường crypto,cảm ơn bạn