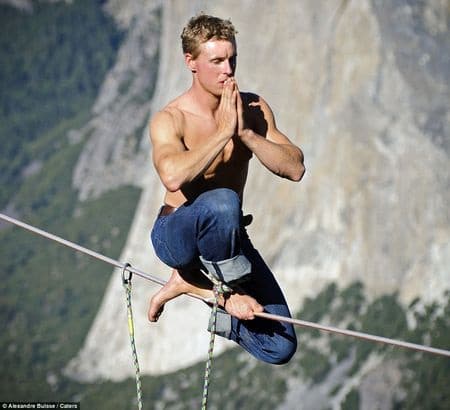

Perhaps all of us have seen circus performances of balancing on a tightrope. And did you realize that Trader also has a strange similarity to this extreme performance art?

Keep balance

Maintaining balance is not only in tightrope walking and trading, but in all aspects of life. In life we always have a prerequisite: we need to keep balance. If we lean too much to one side, life will become unbalanced and the longer we leave it, the more harmful it will be.

In Trading, you always need a balance between many factors such as risk, profit, time, health, and family. This is a circle that we always need to control and recognize to adjust whenever there is an imbalance.

If you focus too much on profits - this is something new traders often encounter, it can cause you to burn your account because you ignore risk management, or put your body in a constant state of stress, causing harm to your health. , mentality.

If you are too afraid of losing money and do not accept risks, do not dare to trade with a real account or the profits from the market will be low, not worth the effort you put into trading.

Balancing will not be like a mathematical calculation that always applies the same way, so we cannot have an exact number. Each person will have to make adjustments that are suitable for themselves, suitable for each time. .

For myself, in the past, when I was young, I would have been willing to accept risks and spend more time to gain profits and a better knowledge base.

Now that everything has met my expectations, I can relax and have more leisure, mainly investing in large frames, and spending the rest of my time on myself and my loved ones around me.

Practicing hard is a prerequisite

To achieve such skillful performances of balancing on a tightrope, behind each artist are thousands of hours of arduous practice. And Trading is the same, no one can make a profit from the market without going through practice.

Fortunately, we do not need to pay the price of losing orders, or wait for the real-time chart to run to increase our practice time because there is a backtest feature from Trading View. This is the way I always advise people to practice to make quick progress, and verify what they have shared.

If you don't know how to practice through the backtest feature on TradingView, you can read the article Instructions for using TradingView to analyze and backtest Price Action.

Psychology is an important factor

In balance performance, psychology is a very important factor. Requires performers to concentrate intensely on every small movement and every breath.

If the performer is not confident, shaky or subjective, the performance may not be successful. Psychology can easily be affected by many good factors at that time,... But if you have a strong mentality like during the training process, you will easily succeed because it is all a lot of practice.

Trading is the same. Technical factors and practice are also very important, but at the time you enter an order, the psychological factor is the most important thing.

Greedy psychology can cause you to have FOMO on bad orders leading to losses.

Fear can make you not dare to enter an order, or if you cut the order early, the price will tend to rebound a bit.

Anyone who has been in the market for a while will realize the importance of psychological factors when trading.

Risks will be reduced and you will be more confident if you have an insurance cord

Tightrope walking performances often take place on very high ropes, even in circuses. If the performer makes a mistake and falls from that height, it can cost their life. .

But the risk will be reduced, and the performer will also be more confident and less shaky if there is a safety rope or a safety net underneath.

And similarly in Trading, we will be confident and reduce risks with stop loss, this is an indispensable tool if you do not want to burn your account or lose all your previous profits.

Because if you have money, you can do it again. Even if you are right 10 times, if you are wrong just once without a stop loss, you will lose everything.

Insurance helps tightrope walkers keep their lives, stoploss helps traders have money to continue!

Success needs to be measured over a long journey instead of a few steps

When balancing on a rope, the show is only successful when the performer goes from one end of the rope to the other, so taking a few steps does not bring much meaning other than having a start. favorable.

I see a lot of people, when they make a little profit from investing or trading, they will post it on social networks like it's their daily income and multiply it to get monthly or annual income.

When I see these posts, I understand that they are still F0 newcomers to the market because in the financial investment market, your success can only be measured in a long journey instead of just a few steps.

I myself have gone through similar stages before. Although it's not like uploading to social networks, there are certain illusions and subjectivity when having a little success and then having to pay the price.

Anyway, at that time, I still thought optimistically and felt lucky, so I experienced early losses so that I could see realistically early to try to learn and manage capital better, rather than fail late, the consequences will be big. more.

If you currently encounter failures or early losses, take it as luck!

I am losing direction and method, no matter what method I use I lose and I am very stuck in life, I hope you can share a direction to help, thank you medio

What you need to do now is choose the method that you feel is suitable for practicing well, do not jump from one method to another. Every method has its right and wrong cases, so we need to choose the method that we feel is suitable for ourselves.

Whatever method you use, you should backtest and practice thoroughly, then trade with a small account first.

If you feel stressed and disoriented, stop for a week, a month, or a few months. When you feel you have enough energy and are no longer affected by negative emotions, return to the market.

Thank you for your sincere sharing, Trung. I am also lost because there are too many trading methods and systems on the Internet.

Hey medio, please continue making videos. I'm looking forward to each of your new videos.

I also follow the Gu pair like you, I use the pro package but from 2020 onwards I have only been able to backtest m15, like I know the main trend, know the chart so I feel a bit subjective, if I want to practice m15, should I switch to another pair to backtest, or backtest h1 h4 in 2015-2019?? I hope to receive your reply medio> thanks

You can backtest on other pairs like EU, AU too.

yes thanks

I'm trying to only enter 3 orders per week.

good luck at the beginning of the year win 2/2

1TP, 1 thin profit hehe

I am confident

At the beginning of the new year, I read your articles again to absorb them deeply to continue on my trading path. I wish you and your family a 2022 full of health, happiness and many new ideas to make more videos =)). Sincerely thank you!

Thank you. Wishing you and your family a healthy and successful new year.

Hello medio, I am so lucky to know you and the knowledge you have shared. And there is something I want to tell you. I really like your voice. And for a long time I have been looking for ways to practice my speaking skills to improve because I am a person with very poor speaking and presentation skills. I am trying to imitate your voice in your video. In the video on the limit command for busy people, you said that you have improved your speaking skills. Can you share with me how you practice it? Thank you. I hope I can speak like you, that is enough. ^^

Actually, I think you just need to practice a lot. You can speak, record yourself and then correct it. In videos, you often don't have to record it all at once. I also had to re-record many videos because I made mistakes when speaking.

Nothing is perfect, especially things that look good and perfect online. Even these articles I often read and edit over and over again.

I am also in this market, although there is no profit yet, I still try my best every day, thank you, thanks to you, I understand the market much better!