Book Review: How I made 2,000,000$ from the stock market?

Although I have had this book on my Kindle for a long time, I have not opened it to read for the following reasons: the book is about the stock market, while I focus on Forex & Crypto, the book was published a long time ago (since 1960). Another very important reason is that the book cover looks “a bit rustic”.

This is probably the fastest investment book I have ever read. Firstly, because the book's content is very engaging and attractive and the author has psychological experiences when investing that are relatively similar to mine (perhaps similar to many other traders). Second, because it's quite...thin, only 228 pages.

About the author

Many pages state the information: “Author Nicolas Darvas is a dancer, self-taught stock investor, and author. There are some information pages that say he is the world's most talented billionaire in stocks next to Warren Buffett and Soros."

I found this information incorrect and looked it up on Wikipedia. He is a relatively successful investor but not the most talented billionaire, and even less famous than Buffet or Soros.

But because he was originally a dancer, this book is even more suitable for me and those who are amateurs in the investment market. After all, the world does not have many great people like Buffet, Soros, Munger, etc. I just need to be profitable investors, achieve financial freedom, and have the rest of the time free to do what I want. That's enough. hehe.

Content of the book

True to the name of the book, the author tells about his journey to achieve the first 2,000,000$ in the stock market in about 18 months from 1956.

Since he was still a naive dancer, not knowing what stocks were, he received salary for performing as a dancer in stocks (equivalent to the salary price) from the two brothers who owned the bar where he performed. to act. In addition, he was also very smart to have a condition with the bar owner that within 6 months, if the value of those shares fell lower than the value of his salary, they had to compensate him for the difference.

And some time later, the profit of that stock more than doubled and he had a profit of 8,000$ (the loss was compensated, but the profit he kept all. haha. Really clever). When I realized that I had to work hard to get paid, this game of buying stocks without having to do anything made me many times more profitable. The bewildered golden deer entered the financial market with a dream of wealth.

He found himself a broker, took the trouble to seek advice from people around him, rich people about which stock codes to invest in. Read articles, subscribe to stock magazines and get advice from experts. Each person gave him different advice.

He also learned how to read and analyze company financial reports, although for a dancer like him, this was not easy.

But the strange thing is that after buying according to that advice, he lost most of the profit from his previous lucky deal.

The event that changed his investing life was when he had to tour around the world. With the limitations of the communication system at that time, he had to receive stock quotes by telegram from the broker with very basic information about the day's price, no phone calls, no news, etc. He seemed to be isolated from Wall Street except for the telegrams from brokers and the magazine listing stocks that were sent once in a while.

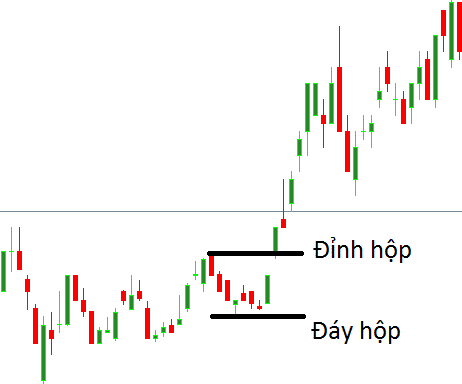

This seemed difficult for him, but in the end it helped him find his famous "box" principle about stock prices. After many times of buying stocks and having to sell them at a loss. He discovered that stock prices would move within a certain range, then could jump to a new range (which was not called a “box”) and move within it.

That means that when the price starts to jump over a new box that is higher than the price is likely to rise, he will place a stop loss order below the high price of the box below so that if the price falls back to the old box, he will limit losses when prices fall.

You may have noticed. This is also the beginning of technical analysis of support and resistance.

He also realized that the way to find potential stocks is an "unusual" change when trading volume increases compared to the past, showing that there is a force holding information that is actively collecting goods. .

All of this is represented through “boxes” and trading volumes. When you know the news is announced, the underground forces that know the information have already gathered the goods. By the time you know it, it is relatively late. That's why when good news is announced at the price you bought it for, the price drops like your pants are falling off. That's because many people have already collected goods before taking profits.

You should read the detailed developments of his investment during that tour in the book to clearly understand what he went through and the lessons he learned.

After that world tour, he made a profit of half a million dollars. When he returned, he felt like he was a star when he became rich and confident about the investment method he had found. Tu confidently stepped into Wall Street, he chose a broker and sat there every day with a majestic office and seat like a professional investor.

Yes, as a law that has existed for a long time. When you are overconfident in yourself, you will receive a "shock" from the market. I also ate a few times like that. To the point of asking myself why every time I'm making good progress, I get pulled down. And that reason is: overconfidence in yourself when investing. After reading books and watching other investors' YouTube videos, I realized that many people encounter similar situations.

When I lost half of the half million $. He asked himself this question: Why am I becoming like this? Ignore your previous investment principles. He realized that when he sat with other brokers and investors, he became assimilated.

By listening to the news, he panics when they panic, he is optimistic when they are optimistic, he sells when they sell, he blames when they blame. Instead of investing in a few potential stocks like before, he invested in a bunch of different stocks according to what was happening around him. And that is the reason why he lost money! The worst thing is that he lost all faith in himself, in what he had achieved before.

There is a great saying that couldn't be more true in this case:

When you realize you are in the majority, it's time to stop and reflect!

To solve this problem, he went to France to "isolate" from Wall Street and forced his broker to send telegrams like before, only allowed to quote the price of the stock he requested, and not allowed to call him. . After a week, the numbers gradually became clearer to him.

And the previous success has returned. He returned to America and even though he was very close to Wall Street, he still asked his broker to send telegrams like when he was abroad.

We get another experience that is that there is no need to listen to rumors, news,... everything can be solved with technical analysis.

This is something that can still be applied today in markets, including Forex or Crypto through technical analysis. The school of analysis I follow is Price Action by looking at candles and analyzing price action to know the market psychology at that time. I also tried that when I read the news and saw other people's analysis, my analysis became inaccurate.

Thanks to the book, I also affirmed my opinion of not watching news and press information. Because everything has been shown on the graph and the market. This news only makes you more confused. And you will always have news slower than the market.

I do not go to forex news, analysis sites or betting and investment sharing groups. Just hone your abilities with knowledge, practice on charts and record the experiences learned.

Who is the book for?

- Those participating in the stock, forex, and crypto markets can read and refine their own knowledge.

- Newcomers joining the market to gain more knowledge about the financial market and orient their own trading style, avoiding negative sources such as groups, news, and the importance of risk management .

- Investors who are losing confidence in themselves (like me) when experiencing temporary slowdowns because the author's sharing is very appropriate. True to the psychological factors of many traders.

- Those who are amateurs want to participate in the financial market, because the author is also a dancer, not a person studying finance. We don't need to understand financial reports to be successful, but we do need to supplement our knowledge in our own way.

summary

This is a book that was published a long time ago, but there is still a lot of knowledge you can gain from this book. The main purpose I feel is to understand better and strengthen confidence in this harsh financial market.

I consider this a book worth reading if you are investing in the financial field such as stocks, crypto,...

When reviewing books, I usually try not to reveal too much of the book's content because it will make the book less interesting for readers. Above are just a few details that I give to help you decide whether you should read the book or not? If you find it appropriate, you should read the book to see its appeal and draw your own lessons instead of reading what I wrote and thinking you know the whole book already.

Wishing you happy reading! If you find the article interesting, please leave a comment or give me a like!

Medio này có vẻ ít ae bình luận nhỉ, em thích đọc hơn là nghe nên thích nghiền ngẫm trên này.

Cảm ơn anh đã chia sẻ !!

Mọi người thường hay thích xem video trên youtube vì nó tiện và ở trên đó tương tác nhiều. Nhưng đọc sẽ giúp mình rèn luyện suy nghĩ nhiều hơn.

“cách ly” chỉ nhìn biểu đồ giá 1 – 2 lần ngày khi đó sẽ kiểm soát tâm lý, lúc mình vào thị trường cũng vậy giờ đỡ nhiều hơn, tìm 1 việc gì đó làm và cầm điện thoại đen trắng :))) khi nào về đến nhà mở máy tính lên thì mới xem biểu đồ, còn lại để thị trường lo

Chuẩn rồi bạn.

Link trên bài đăng Góc Biểu đồ đưa m tới đây. Dạo gần đây m thấy sợ và k đủ tự tin để vào bất cứ lệnh nào do back test lại m thấy toàn vào lệnh sai. Nên mặc dù phân tích rất kỹ nhưng khi đặt lệnh lại vẫn lăn tăn. Cho hỏi bệnh này m phải chữa sao ah. Cảm ơn b nhiều.

Backtest lại vào lệnh vẫn sai mình nghĩ bạn vẫn chưa hiểu kỹ hoặc vận dụng thuần thục phương pháp nên hãy cứ backtest để có tỉ lệ win cao hơn rồi hãy vào lệnh thực tế nhé bạn!

Mình biết đến và bắt đầu gia thị trường được 3 tháng rồi. 2 tháng trước mình cháy tk nhỏ. Đến bây giờ chỉ backtest, nhờ luyện độc 1 pp của b mà tỉ lệ thắng của mình nhiều hơn thua r. Chắc là tới lúc bỏ tiền vào để luyện tâm lý và quản lý vốn. Cảm ơn những chia sẻ của bạn. Đợi bài viết tiếp theo của b.

Cuốn sách này mình đã đọc hai lần, sau khi mình trải nghiệm thử trường 1 năm, đọc thấy mình trong đó và cũng vỡ ra nhiều điều. Cảm ơn ad

Chào ad, mình cũng tham gia FX được 1 năm nay, tình trạng chưa được gọi là tốt. Mình cũng đã học “qua” quá nhiều thứ,biết hầu hết các chỉ báo, pp nhưng kết quả giao dịch thì không khá lên được là mấy. Mấy tháng trước, mình nhận ra sự chuyển động của sóng ở tất cả các khung thời gian đều có quy luật như nhau, và quyết định không đọc tin tức, bỏ hết telegram, không xem nhận định và thực tập giao dịch theo ngày (vì một ngày ví dụ cặp EURUSD chỉ dao động trung bình từ 70 – 100pip, GU thì gấp rưỡi số đó), khi đó chúng ta có 1 điểm vào lệnh với SL là 15 – 20pip thì khả năng thành công sẽ cao hơn. Rồi gần đây, may mắn mình biết đến kênh MEDIO, nhận ra đây là những điều mình đang tìm kiếm, mình càng tự tin về những gì mình theo đuổi. Coi hết các video và thực tập, hi vọng 1 ngày gần nhất có chút thành tựu với nghề này. Thực sư là 1 nghề rất khó. Cảm ơn ad vì những kiến thức và cảm hứng bạn đem lại!

nhiều lúc em liên tưởng mình là con trâu. nghe đàn không làm sao mà hiểu được, nhưng cứ roi vào đít một phát là thông minh lên ngay

Mong anh ra nhiều bài đọc hơn, thực sự không chỉ ngưỡng mộ về cách anh đầu tư trong thị trường mà còn ngưỡng mộ về cách sống của anh nữa

Cảm ơn bạn đã ủng hộ nhé!

Add ơi, add có file đọc trên kindle ko ạ, cho mình xin có được ko ạ, mình cảm ơn nhiều ạ

Bạn search Google sẽ ra nhiều bên chia sẻ bạn nhé.

Youtube dạo này không thấy có video mới từ Medio ạ?