In investing or business, everyone has probably heard the saying "Don't put all your stocks in one basket". Oh, I was wrong, "Don't put your eggs in one basket". This is also the investment philosophy considered advice by old Mr. Warren Buffet.

However, to apply it, we cannot mechanically apply it by putting as many baskets as possible, but we need to apply it flexibly and scientifically.

This principle not only applies to investing in stocks and coins, diversifying income sources, but also applies very well to minimizing risks, and becoming a Trader who always profits from the market. People can also avoid going all-in into the ground, or sending the whole family out to the dike.

And here are a few small tips from my personal experience, you can refine the information you find useful.

How to divide "eggs" in different markets.

Forex

This is the place that brought me to the financial market, which is also the market I feel confident in, love and have the most experience in. And also the place whose past left me the most pain.

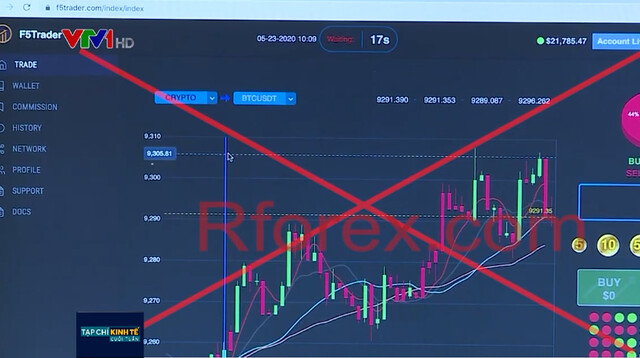

The Forex market has existed for a long time in the world, but in Vietnam, there are currently many erroneous views about this market due to multi-level organizations, fraud, and binary options (BO). rife.

I reaffirm that binary options (BO) is not Forex, this is just a form of red and black Tai Suu style using Forex graphs. Similar to when you use soccer results to bet.

And there is no need to do anything, just give money and make money, no risk but receive money regularly every month. 100% is a multi-level, Ponzi form. Don't participate in these forms because of greed, stupidity, blindness and ignorance, then lose everything and say it's because of Forex - it's not a weird Forex...

Eliminating these fraudulent markets that are being equated with Forex, Forex is a market that can make regular profits without depending on economic recession. By:

- The trading volume is large, estimated at 6,000 billion USD/day, so it is stable, with little price manipulation, very suitable for CFD trading.

- Fast liquidity, high leverage, easy deposits and withdrawals, so very flexible.

- Easy to apply compound interest, and unlimited income.

However, because trading with high leverage carries very high risks, it is not for those who lack knowledge and do not know how to manage risks. At the same time, CFD trading will create a feeling of psychological stress and easily lose control.

With the above advantages and disadvantages, although I trade the most in Forex, I only allocate a small portion of assets about 10 -15% (previously it was much more) to still have a regular income and promote effectiveness. of compound interest without being psychological.

Always remember: "A sharp knife can easily cut your hand" so learn how to avoid cutting your hand before chopping chicken... I have also cut my hand many times in this market before due to not having enough knowledge to rush in. Like a moth, the feeling will not be pleasant!

So find a way to not lose or lose a little so that when you have more trading knowledge, you will still have capital to trade.

Stocks, Crypto (Electronic Currency)

I group these two markets together because they have relatively similar characteristics. These two markets are much smaller than Forex, so they are susceptible to price manipulation and stophunting, so I consider them not suitable for leverage trading like Forex.

These two markets will be suitable for speculation, buy-to-hold investment, more like an asset class.

Investing is more leisurely than trading Forex because of analysis on large time frames such as D, W, M and brings high profits when the market is in an uptrend if you know how to find reasonable entry and exit points.

However, you will need to wait longer for the opportunity so it is not suitable for those who lack perseverance. Depends a lot on market trends.

It is also very easy to experience FOMO in the form of "What code to buy, what coin to hold" according to the opinions of others and the media, so it is easy to swing to the top if you only know how to follow the crowd.

If you have used the Price Action method that I still share in Forex, then moving to the large time frames in this market to find buying points is quite easy. Of course, there must be basic analysis to select stock codes, coins with real value, capitalization, large trading volume, etc.

The benefit of participating in these investment markets is that when you diversify your income sources, there will be less psychological pressure when trading Forex, so you will also avoid uncertain bets and have a high winning rate. go up.

How to divide eggs into multiple baskets for this market, please read in the details below. In this part, I will give an overview of the markets first.

Yellow

If cash is tied to countries and political systems, it can become worthless. While land can be confiscated, gold is an asset that has endured through many periods. From the time when great knights roamed the streets, they threw gold pieces the size of a fist into pressed pieces and embossed them beautifully like today. Therefore, the price may increase or decrease in each period, but Gold always has value and is recognized in different regimes and countries.

Luckily for traders, Gold also has graphs, and can also be easily analyzed with Price Action in large time frames like D, W, M like Stocks and Crypto. Therefore, we can also easily analyze trends and find buying points to store Gold safely and profitably in the future.

In my opinion, this is probably the safest asset that we can buy to accumulate and keep capital.

Cash

Previously, on the Youtube channel there was a video about investing that I shared that I kept a few dozen % assets in cash. There are a few comments criticizing this type of investment, if anyone keeps cash or deposits it in the bank, the money will lose value due to inflation, etc.

In my mind, I think this is probably a genuine F0 in the investment markets, and I have not yet enjoyed the taste of swinging to the top...

I keep cash not to get interest from the Bank. It's to wait for prices to recover or fall deeply in markets like Crypto to buy. And while you're swinging to the top, hold your assets and divide them a few times, wait a few months, a few years to break even. At that time, I bought in, and by the time it reached your price, I might have multiplied my account several times...

I went through the period of holding coins from 2017 until the uptrend market returned, so I clearly understood how valuable cash was then.

Just one uptrend can change your finances, don't underestimate the value of cash!

Summary: In addition to Forex, I divide the capital from only 5-10% to trade, the remaining markets will have capital allocated depending on the time and direction of the current markets. During the uptrend season, we will gradually convert to cash so the amount of cash will be more, and vice versa. And now I also limit the risks a lot more than a few years ago.

P/s: Absolutely only use idle money, do not use borrowed money to invest!

Secrets of the "egg selling aunt"

- Divide the types of eggs we sell into: chicken eggs, duck eggs, quail eggs,...

- Then divide these types of duck eggs into: industrially raised duck eggs, clean duck eggs, balut eggs, etc.

- Then divide it further, for example, industrially raised duck eggs into: industrially raised duck eggs that are newly sold at higher prices, industrially raised duck eggs that are about to rot to sell first, industrially raised duck eggs that have rotted to sell to those who like to play. pranks or debt collectors,...

Applying the aunt's lessons in the markets

I do not invest in the Stock market but mainly in Crypto because I like technology and new markets with fast liquidity. In new markets like Crypto, the uptrend and downtrend cycles will also be shorter.

Therefore, I will share some tips for placing eggs in many baskets in the Crypto market. On the securities side, everyone can apply similarly:

- Divide capital at price ranges at important key levels D, W, M as I have shared on Youtube or in the article Bitcoin Price Analysis & How I Think in the Coin, Crypto Market 3 I have shared with everyone on Hoi Quan.

- Don't leave all your coins in one exchange, store coins in different exchanges, cold wallets, etc.

- Don't go all in on one coin, but divide it into coins representing different fields.

Divide capital into different coins for example:

- Bitcoin collectively represents Blockchain technology

- Ripple or Stellar represents the application of blockchain to banks

- XMR or ZCash for completely anonymous coins are often used for the black market (the black market is the market used for purposes such as money laundering, illegal payments, not the market to buy porn movies).

- Ethereum for smart contracts.

- Binance or Huobi represents the tokens of the exchanges.

…

But remember, everyone should only invest a few codes, not because reading this article I said to divide eggs into many baskets but the machine divides them into several dozen baskets, each basket holds 1 egg...

Similarly, in stocks you can choose codes representing different industries. Doing so will avoid unexpected fluctuations that affect the value or community of that coin.

For example, governments completely ban the use of completely anonymous coins such as XMR and ZEC because most of them are used for money laundering, terrorism, and criminal purposes. Or like the tourism and aviation industries affected by Covid. Causing these codes to decrease is the opposite even though the general market trend is increasing.

In addition, psychologically, dividing into different coins also prevents you from having FOMO when you see your friend holding other coins increase rapidly, while the coin you hold does not see any increase. Too spicy. Sell it all and then switch to the other coin, then that coin starts to decrease, the coin I just cut suddenly increases again... repeat that a few times. In the end, I blamed fate for not being rich.

That's just because of you, God doesn't like people who go into the Karaoke room and compete for the mic to sing the song Come Sau by Ung Hoang Phuc over and over again 10 times. So to make God hate you less, divide these 10 times into different times of singing...

Legend of the legend of the All-in school

Many of my fellow Traders idolize Jesse Livermore - consider him a Trading legend, even create an avatar and nickname themselves this name. But when reading Livermore's biography, I think he is more of a legend of the all-in school. And much of what's left is about scandals:

- Many times all-in got rich overnight, and many times all-in and lost everything.

- Likes to get rich quick, trading in the black market

- Listening to investment advice from others to the point of losing everything a few times (and also making a profit sometimes)

- Notorious for concealing information, buying insider information, manipulating the market,...

- Eating and drinking,…

Then in the end he committed suicide in poverty... and bad reputation in society.

And I also don't consider Jesse Livermore an idol. Because it's not the same as my purpose in Trading. Of course, it's up to you who you idolize, but when you idolize someone, you will tend to follow what that person thinks and does. I also wouldn't be surprised if someone who idolized Livermore would have the desire to get rich quickly, use tricks, blow up their accounts, etc.

This article is good but why is there no comment :))

I have just watched medio's channel for a week. I feel that you are a person who is very dedicated to the market. I entered the market by myself. Since watching medio's channel, everything seems to be reoriented. I have always been wrong and wrong. Thank you Medio very much!

Account was burned once, hope it won't be burned again.

I think it needs to burn more, it's not easy.

Who knows the email address of Mr. Medio, please give it to me

deeply, hope to receive more sharing from you. Wish you Trung always good health and success!

I still wonder, what is the difference between investing and trading? It's still a trade, finding entry points, taking profits, cutting losses, just different time frames! Or is investing a valuable asset so there's no need to cut losses, but the average price when buying drops, but every stock investment legend advises cutting losses, no one has ever advised DCA. I hope Mr. Trung can help me answer!

I think the difference is that investing has no selling.

That's right, there's only buying, no short selling, but what I'm most interested in is the issue of stop loss or DCA when investing in valuable assets like gold, coins, and stocks!!

Trading is using margin to increase the stop loss level as desired.

Instead of investing like you are trading but the stop loss is at the value of 0$. And because the asset value increases over time, the asset reaching 0$ is very unlikely. And of course, you should only DCA, not cut losses at all. The reason is quite long to explain. Hello.

Thanks, but all the great stock investors or famous books say that cutting losses is a must, they strongly refute DCA, that's how they became legends in the financial market, is DCA too risky?

In my personal opinion, investing is different from trading in that:

– long holding period

– no leverage

-and only buy (sell when taking profit and cutting loss)

Right, but I'm concerned about the problem so cut loss or DCA when investing in valuable assets like gold, coins, stocks, bro !!

Hi Mr. Tuong Luong,

I understand that big investors do not DCA but cut losses.

1/ When you have accidentally invested/speculated in codes or coins that have no real value, just to surf for short-term profits, when these codes/coins go against the trend, it is best to cut them. For example, Luna coin with the division rate like in 2022, no matter how many times you DCA, it will be very difficult to recover.

2/ The fact that a coin/stock code is praised for its potential is also from the media, it is only potential when the management team is still active. For example, in 10-20 years, The Gioi Di Dong will no longer have the current management team, will the price of MWG on the stock market still be as good/valuable as it is now?

That's my personal opinion, it may be right or wrong. Hope to receive more comments from everyone.

For stocks, I will buy DCA VN30 ETF funds to avoid risks when investing in only 1 business.

You are very passionate about ace traders, only those who have lost a lot in the market can understand. I really like your school. Minimalism is the pinnacle. Trying to eliminate indicators!!!

Thank you! I also hope what I share will be useful for everyone!