Leave the market when downtrend

Maybe some of us still have many doubts about Crypto, especially those of you who are familiar with traditional markets because Crypto is not protected by law, has strong fluctuations, and many complex technical terms, so there are many scams. .

Với bản thân mình cũng vậy, trước đây mình có thời gian dài coi Crypto ( thực ra lúc đấy chưa có thuật ngữ này mà mọi người đều gọi là coin) là ảo, bong bóng và không quan tâm mà chỉ tập trung vào Trading.

Nhưng đúng là không cưỡng lại sức hút của đồng tiền, ban đầu nghe và đọc mình không quan tâm vì nghĩ là ảo. Sau khi nghe chính thằng bạn mình kể nó kiếm nhiều tiền từ coin dù vẫn nghĩ là bong bóng nhưng mình vẫn ham và tìm hiểu.

Khi đó thị trường còn rất sơ khai, sự thật dù mình đầu tư một phần nhiều tài sản của bản thân vào Crypto nhưng khi đó mình không mang quá nhiều niềm tin mà chỉ mang tính đầu cơ là chính.

Because at that time, I didn't really believe in coins replacing traditional, decentralized currencies, changing the world, and applications in other fields were not yet real and were only on paper.

But at the present time, even though the market is down very deeply, and maybe even deeper, I still have full confidence in the market because the crypto market and Blockchain technology are now very different.

Có 1 khoảng thời gian trong downtrend mình không quan tâm đến Crypto nhiều. Điều này một phần do mình tập trung vào FX là chính, một phần do downtrend dài sẽ ít để ý tìm hiểu sâu về thị trường.

And if you don't learn, you won't know the platforms and technologies that are still "silently" developing during that time.

And that was my biggest shortcoming, because later when I learned more deeply about the technology of the platforms, Defi, GameFi, NFT,... I was only surprised and confused when the market was very different from before. Already.

I hope both I and everyone else will not be like me at that time. Leave the market, delete the app when the trend is down and miss the opportunities.

Returning to the main content of this article, I will try to share the most stress-free and leisurely way to automatically invest, optimizing profits and time so that people do not have a lot of time or understand too much about technology. can also be done.

That uses the Auto Invest feature from Binance

Warning: Investing in financial markets is a risky market that can cause you to lose all your money. Please research carefully, control risks and only use your idle capital.

Operating principles

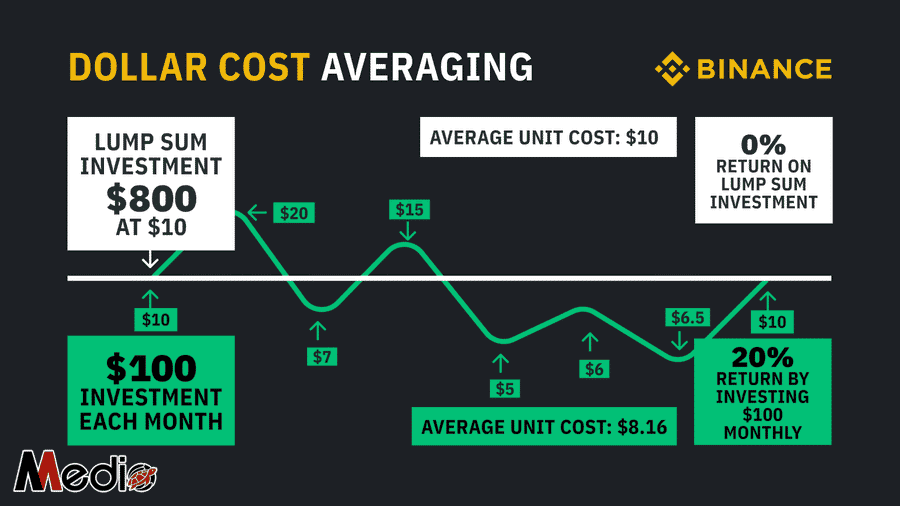

The operating principle of this investment method is to use DCA

DCA (Dollar – Cost Averaging) is also known as price averaging strategy. This is a strategy in which investors will divide the investment amount into many different amounts, instead of investing it all at once.

The volatility of a financial product is the risk of going up or down, and cyclicality is something that always happens in financial markets. DCA will help mitigate the risk of measurement volatility by attempting to reduce the average total cost of investment.

In the simplest terms, DCA is a strategy of dividing the investment amount into many different parts instead of investing it all at once. Unlike the strategy of buying low and selling high, DCA will not help investors maximize profits but only focus on minimizing losses, taking advantage of advantages and growing in the long term.

This strategy is most often applied in the fields of finance, stocks and cryptocurrencies.

However, what you must remember should not be applied to coins with high volatility, poor liquidity, junk coins, etc.

How will automatic investing from Binance work?

Binance will help you periodically buy crypto coins according to a set cycle plan such as daily, weekly, monthly, every 2 weeks,... at a certain time that you set.

For example, if I set up every day, I will use 10 USDT to buy Bitcoin at 6am every day. Regularly over a long period of 2-3 years and accumulate until the price is high and you want to sell.

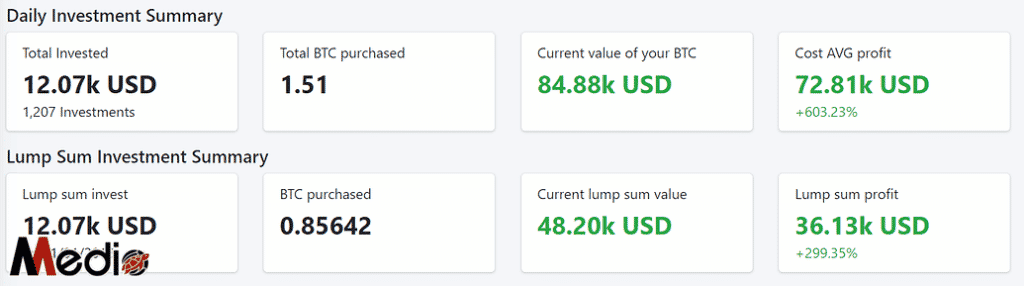

For example, every day I invested 10$ in BTC from January 1, 2018 to April 21, 2021 (about more than 3 years) with a transaction fee of about 0.02%.

BTC price on January 1, 2018 is: 14,093 USD

BTC price on April 21, 2021 is: 56,294 USD

And this is the result

Here, everyone, please help me with the above parameters to compare between buying DCA 10$ every day (top row) and buying it all at once (bottom row).

DCA's profit will be more than 600% over 3 years. A number that is not small, passive and relatively safe.

With 10$ save every day (~ more than 230,000 VND). After more than 3 years you will have an amount of 84.88k USD (~ nearly 2 billion VND)

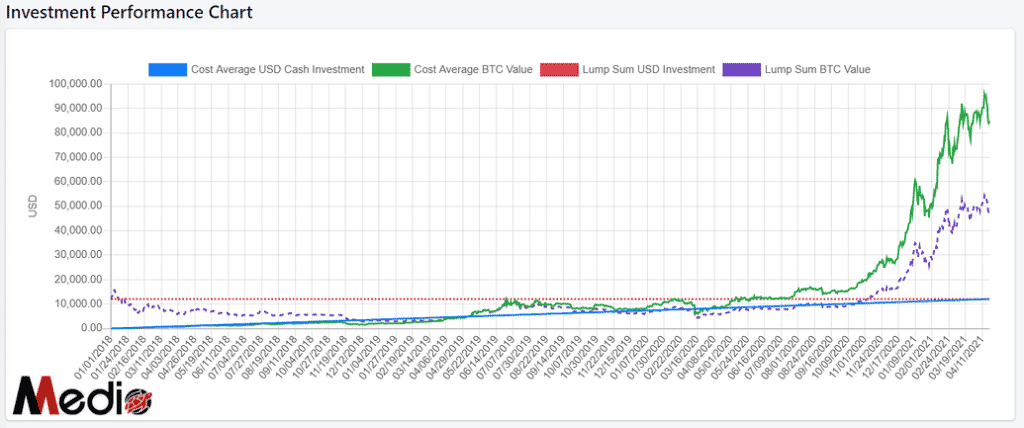

In addition, let's compare buying all in 1 at once and using DCA through the image below

The blue line is the value of the investment according to DCA

The purple line is the investment value according to buying all in 12.07k USD on January 1, 2018

Here, I randomly choose, for example, the starting date of BTC price is 14,093 (not the bottom of the down cycle), the selling date is April 21, 2021, the price is 56,294 (not the top of the up cycle) because we It is impossible to choose to sell or buy exactly at the bottom or top.

As you can see, at the end of 2019 after nearly 2 years, these two investments have equivalent values as shown by the intersection of the two graph lines.

However, at this time with DCA I have only invested more than 7k $, but with the all-in method I have invested 12.07k$.

And more and more over time you will see a breakthrough in your investment using DCA every day.

You can see more detailed statistics of the above example, accurate to each day, here: https://dcacryptocalculator.com/bitcoin/?start_date=2018-01-01&finish_date=2021-04-21®ular_investment=10¤cy_code=USD&investment_interval=daily&exchange_fee=0.02 5

This is purely DCA based on Bitcoin price - the safest coin with the largest capitalization, so %'s growth will also be lower than coins with small capitalization. And not to mention being able to optimize profits further, which I will guide below.

Why should you use automatic investing?

Although most of my capital is DCA using Price Action to buy in Keylevel W and M areas as I shared, I still leave a part of my capital to use this form of Automatic Investment. For these reasons:

Avoid feeling FOMO

One of the most difficult things in investing is experiencing feelings of FOMO, FUD, and emotions when participating, even though we may have had a clear capital allocation plan before, but emotions and greed dominate. we cannot stay disciplined and follow the plan.

Having a capital allocation portfolio using Daily Auto-Buying Investment will help me avoid the feeling of FOMO because even if the market does not agree with the price I set for DCA according to Keylevel, I can more or less buy a little at this price range. Already.

This will support the implementation of your DCA investment plan according to your weekly and monthly framework to maintain more discipline.

Relaxed and Simple

Previously, doing DCA like this every day, although we all knew it was highly effective, but going into the app every day or every week to buy a few coins over several years was very inconvenient and easily influenced by emotions. when I have to check every day to see the price of coins go up and down.

This is both an active and passive way of investing when you can choose the coin you want to buy, set a plan yourself, but don't have to do anything and just wait for the investment to grow.

Advantage thanks to the accumulation and growth cycle of the market

In most markets, people can see that the downtrend and sideway periods are often much longer than the uptrend period. Therefore, by buying the same amount every day, the amount you buy in downtrend and sideway zones will be more than when growing.

Therefore, you can rest assured that you will buy many coins at lower price areas.

No need to invest a lot of capital at once

This method also has advantages for those who currently do not have immediate capital. Instead of thinking about borrowing or raising capital, we just need to regularly put in a savings amount from our salary and income every month. that month.

Disadvantages of automated investing

Of course, nothing is perfect, and this method also has disadvantages:

- It's more about safety than optimizing profits

- When buying in too small a quantity, you will incur more transaction fees than buying in large quantities.

- Not an investment solution to make quick profits in a short period of time.

How to optimize automatic investment

Should buy by day, or maximum by week

The Crypto market fluctuates very quickly and strongly, so we should only invest in a daily or maximum weekly buying cycle to be more optimal.

The minimum cost you can set up and buy is from 1$, so with a small capital you can still buy daily.

Only choose top coins and high liquidity

Automatic investment according to DCA needs to be maintained for a long time through up and down cycles of the market, so we need to choose top coins to ensure safety.

In addition, because we buy in small quantities, when buying top coins with large liquidity, the fees and spread differences will also be lower.

Although Binance currently only allows selecting a small number of Crypto coins in automatic investment planning, there are still many coins to choose from.

Personally, I will choose big coins like BTC, ETH, BNB,... or platform tokens like AVAX, FTM,...

That's my suggestion, but everyone should research carefully before choosing any token for a long-term plan! Because you have to research and believe for yourself to determine long-term investment without being shaken.

Put your eggs in many baskets

To reduce risk, people can divide the daily DCA purchase capital into several different coins. For example, if you plan to buy 10$ per day, you can divide it into 5$ per day for BTC and ETH.

Everyone please help me pay attention to this, the risk will still be there so we need to put our eggs in many baskets, before we had automatic DCA FTT thought the top 2 floor was very trustworthy but still left, luckily we divided many baskets so it was okay. Don't have too big of a problem.

Optimize profits from capital

The difficulty when you join the Crypto market is that you need to use VND to buy USDT and have it available at Binance to be able to buy automatically every day. And the VND and USDT exchange rates will often fluctuate and are not fixed.

Most of our goals will be how to get the most VND. Everyone can refer to how I still do it to optimize profits.

Choose when to buy USDT

Because we don't need USDT immediately at a time to buy, you can choose times when USDT prices are low to accumulate.

Due to supply and demand, USDT price will often fluctuate against the market trend.

- When the market increases strongly, many people take profits and sell USDT, the price of USDT will often be lower

- When the market suddenly drops, many people want to buy USDT to catch the bottom, so the exchange rate will often be high.

- When the market is in a long-term decline and sideways for a long time, USDT price will also be low at this time because many people leave the market so the buying demand is low.

Therefore, to get a good price, we should not rush to buy USDT when the market drops, but wait until the days when the market is green and strong to buy to get the best exchange rate.

USDT reserves available to wait for DCA will still have daily compound interest

A very good point about Binance is that they have a setting to automatically withdraw money from USDT to Flexible Savings to buy coins in Automatic Investment if the Spot wallet balance is not enough.

So you can save USDT with an interest rate of 10% with an amount of 2000$ and above 2000$ it will be 3%. That is, if you save 5000$, 2000$ will be charged 10% interest and 3000$ will be calculated 3% interest. This is a very attractive profit level of $ and interest is also paid daily.

Thus, you will not be afraid that USDT reserves will not bring any profit. In addition, Binance interest will be paid daily to your wallet and also allows you to automatically add this interest to a flexible savings account for daily compound interest.

For those who want to accumulate large amounts of USDT to wait to buy coins on a weekly or monthly basis or receive interest from providing Swap Farming, they can use this USDT interest to automatically buy coins, which is also a way to take advantage of interest. dual.

Note: Although depositing USDT for savings like this, I consider it quite safe, there will still be risks related to Binance or USDT. Therefore, absolutely do not bring all your savings from the bank to deposit on Binance.

Continue compounding interest from purchased Tokens when investing automatically

Tokens purchased daily will automatically be added to Flexible Savings by Binance. To view these, go to [fusion_builder_container hundred_percent=”yes” overflow=”visible”][fusion_builder_row][fusion_builder_column type=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none”][Wallet] and select [Earn Wallet]

The % profit rate will depend on each Token, depending on the time. It is not too high because it is just a flexible savings, but if we invest in the long term of 2 or 3 years, it will also be a number worth keeping in mind. heart. And importantly, this is completely automated so we will optimize profits as best as possible.

Implementation Guide

If you don't have a Binance account, you can register here to receive a lifetime transaction fee discount of 20%.

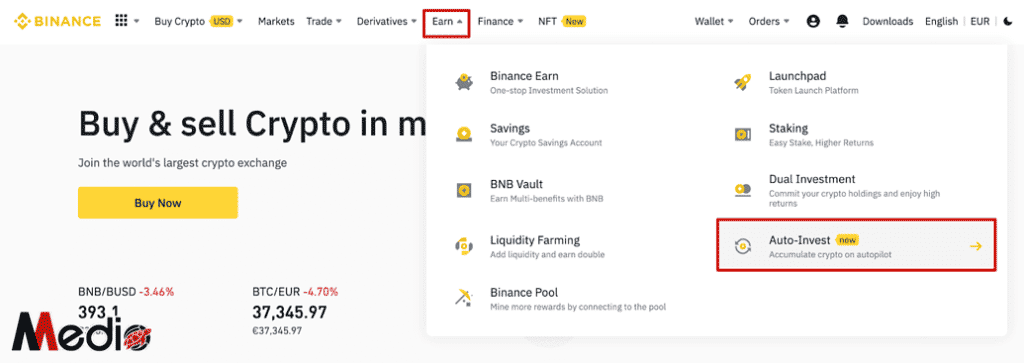

This is a guide I quoted from Binance's guide

- Log in to your Binance account, then click [Earn] – [Automatic investment] (20% fee reduction)

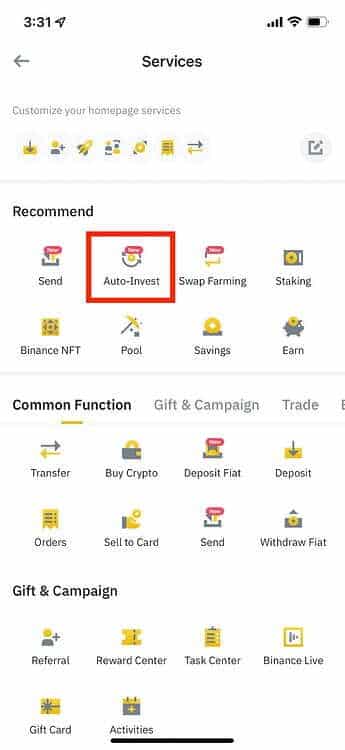

Or, you can open Binance App, then tap [Add] – [Auto Invest].

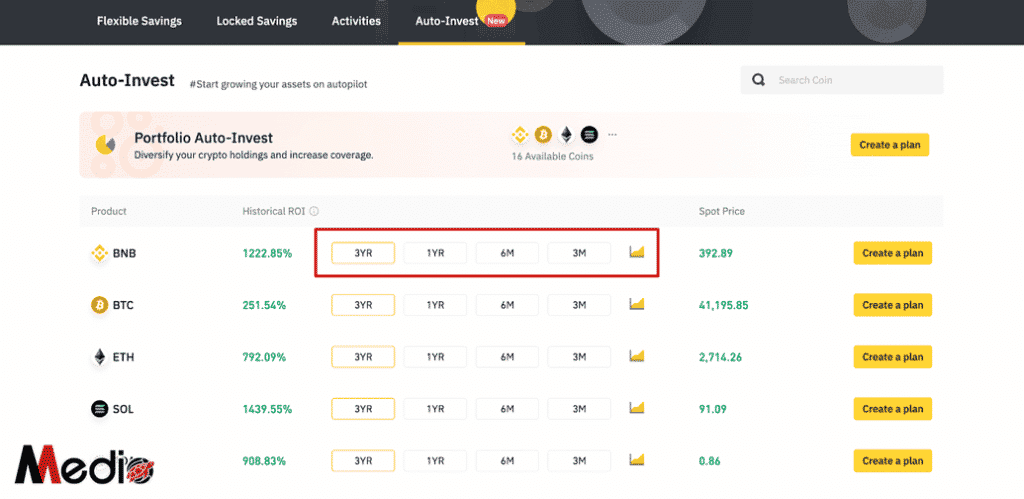

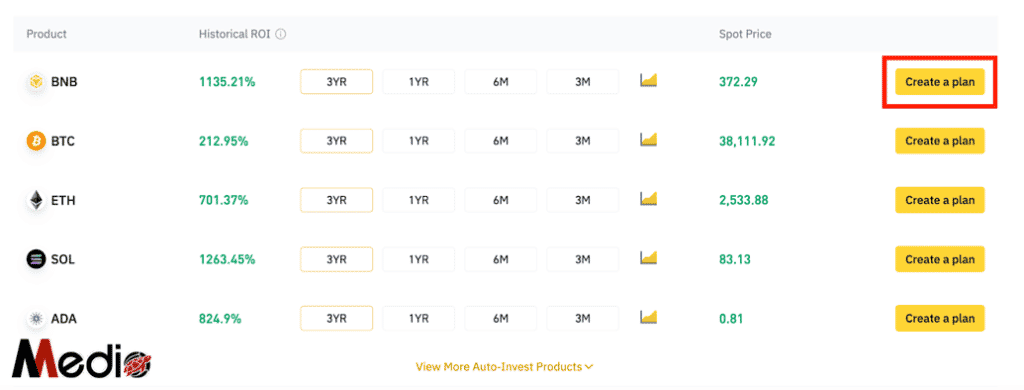

- You will see the cryptocurrency you can use to sign up for Auto Invest.

You can choose to create an Automatic Portfolio Investment Plan to buy multiple cryptocurrencies in one portfolio or create an Automatic Investment Plan for a single cryptocurrency.

Before signing up, you can choose the asset's timeframe to test the simulated ROI. You can also click the chart icon to view the asset's historical performance.

If on the Binance app, you can do as in the following video:

Webpage:

Step 1. Click [Create plan] next to the coin you want to invest automatically.

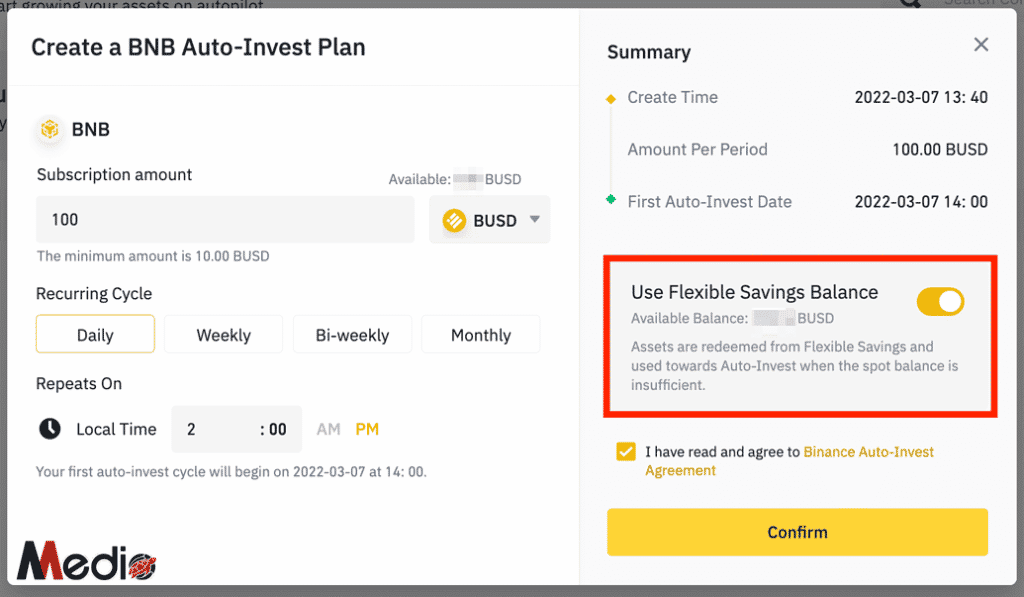

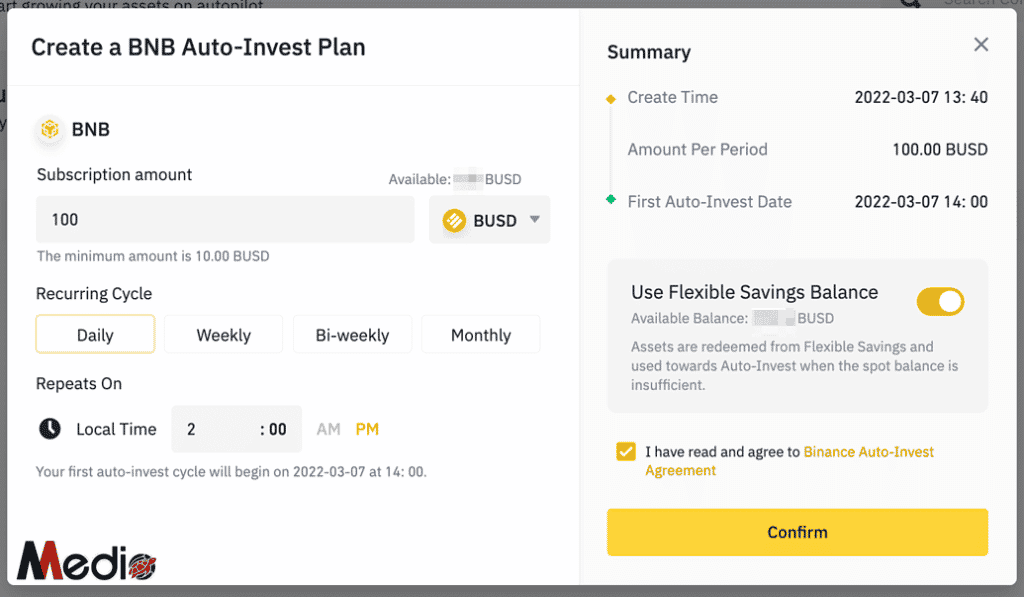

Step 2. Enter the subscription amount and stablecoin you want to use. Currently, Binance supports USDT and BUSD. Choose a daily, weekly, bi-weekly or monthly repeat cycle. You can also set a specific purchase date and time.

Step 3. Choose to enable [Use Flexible Savings balance]. After enabling this option, if your Spot Wallet balance is insufficient, the system will automatically withdraw assets from your Flexible Savings account to complete the purchase.

Step 4. Check the summary and click [Confirm] to register.

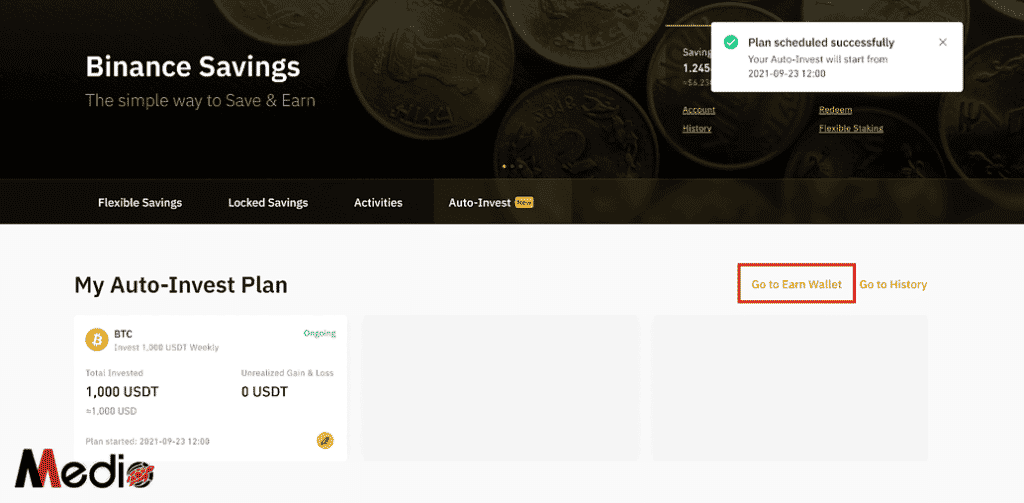

- You can view your current Auto Investment plans under [My Auto Investment Plans].

To manage your AutoInvest plan, click [Go to Earn Wallet page].

To see your AutoInvest purchase history, click [Go to History page].

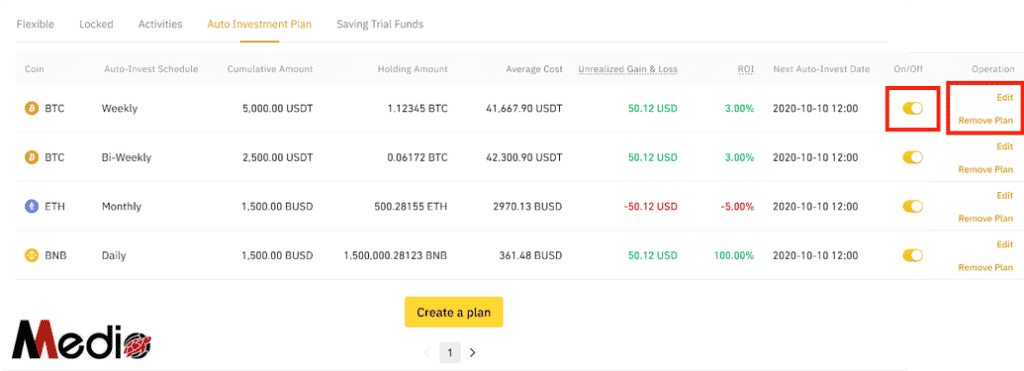

- Go to [Automatic investment plans] to see all plans.

To pause or resume a plan, press the button below the button [Toggle]. To edit a plan such as changing the investment frequency, click [Edit]. To permanently stop a plan, click [Delete plan].

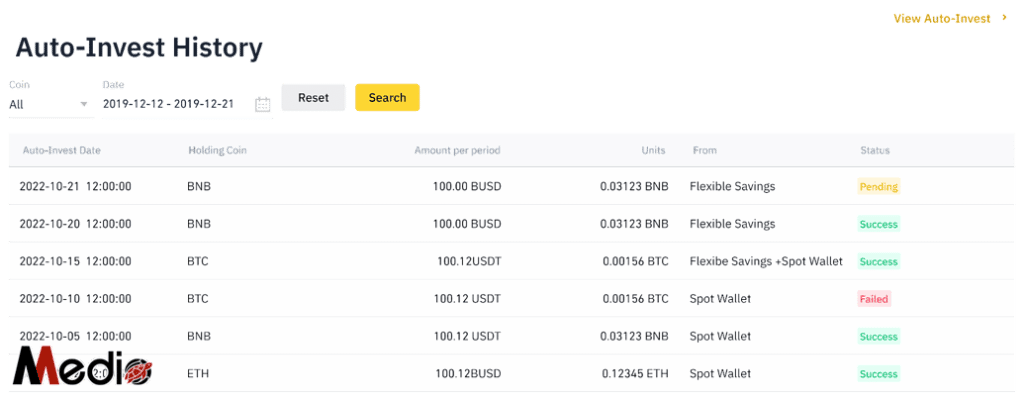

5. You can view the amount of cryptocurrency purchased in the [Auto Investment History] section.

That's it!

In addition, if you want to automatically invest in many coins in a simpler way, you can use the feature to create automatic investment plans according to investment portfolio.

In this part, you will choose the coins you want to invest in and then choose how much capital allocation ratio % Binance will automatically divide and buy. However, I still use the separate settings for each coin as above to manage, edit, and customize more easily. Because I also automatically invested about 3.4 VND, the setup was also very fast.

If you want to create a directory, you can see the instructions below

Buy USDT via Binance P2P

For new friends, there is one very important step which is to buy USDT with VND via Binance's P2P. This is a form of direct buying and selling between users in which Binance is only an intermediary.

Binance P2P trading link here

Regarding P2P trading principles, when the USDT seller posts Binance ads, they will lock their USDT number. When you buy, you will transfer the money to the seller via bank account. After you press confirm money transfer, you need to wait for the seller to confirm that they have received the money transfer from you and the transaction will be completed.

Binance will transfer USDT to your Funding wallet. And you need to transfer USDT from Funding wallet to Spot wallet to use!

Note: When buying and selling, you should choose shops with a large number of orders and a high successful transaction rate (over 98%) because they are the parties transferring and buying USDT, so they will usually be safer and confirmed faster.

In addition, when a dispute occurs, because Binance has already locked the seller's USDT, you can rest assured when trading. If it's been too long since you've transferred the money and they haven't unlocked it, you can choose to complain and send a photo of the transfer.

I have registered for 1 year now I want to upgrade to lifetime, can I?

Investing like this if the downtrend (for example bitcoin from November 2021 to December 2022) will result in heavy losses.

The principle of investing or trading is still to buy low and sell high. You DCA but not enough to wait for the market to rise again and sell, of course you will lose. Above I wrote that it is calculated over a period of 2-3 years.

Most people don't understand the power of time, so they doubt methods and jump around in all directions, while this type of method has been proven by stock market tycoons. Investing this way is very boring. No one wants to make money, it's both long and boring. So even if the method works, they don't want to use it.

Long term investment that you calculate for 1 year is not called long term. Long term is at least 5 years or more to be called long term!

I'm not afraid of long-term investment, I'm just afraid of the risk of Binance exchange like FTX recently. But the article is very useful, thanks Medio.

Buy Ledger X cold wallet to withdraw coins for peace of mind. :)

This method is good, but when the coins I buy this way go uptrend, can I take them out and sell them at any time? Will it be locked?

You can sell whenever you want. Now Binance has an index so you can choose to buy the index. They will automatically distribute it evenly to the top 10 coins.

After reading this article, I went to binace to find out that now I can buy coins daily or weekly with Vietnam Dong visa card, no need to buy USDT on the floor anymore, automatically deduct money from the card every month like paying monthly electricity bill, automatically.

Credit cards are often blocked so you may not be able to buy. Also, I find the exchange rate is usually quite high.

Hello Medio,

I followed the instructions in this article of yours to DCA: I bought 43USDT, DCA each day is 1USDT for BNB coin and 10 USDT for ETH coin, but the status says failed due to insufficient balance? Can you explain and guide me how to fix it?

Thanks for sharing useful knowledge!

You must transfer the balance from Funding wallet to Spot wallet.

+ I re-read the article and saw that you had instructions for this in the article, but I skimmed through it and didn't notice. Thank you for patiently guiding me again.

+ I still wonder about this point: after investing automatically for a while, if I want to stop and withdraw money, what steps should I take? I know this step is common knowledge and I can find instructions somewhere. However, I think if I trust someone, I will trust and follow it to the end, because each place has its own way, so it is a bit vague (To be honest, I have been struggling for a while and still don't know how to withdraw money to my VND bank account when I stop investing automatically:-).

So I think the article should also include instructions. I look forward to receiving your detailed instructions.

Thank you and wish you good health!

I will add it in the next post. Quick instructions: you go to your Earn wallet, withdraw and sell Coin on the exchange to get USDT. Then sell via P2P to get VND as above.

I see the actual transaction fee is 0.2%, not 0.02% as in the article. Please check again!