Hello everyone, this is the first article in a series of articles about Smart Money Concept that I plan to update in the near future. In this first article, I will write an overview of the foundation of the method.

What is SMC?

SMC stands for Smart Money Concept .

Smart Money here does not mean the intelligence of a trader but refers to the sources of transaction money that greatly affect the market.

We're talking about central banks, hedge funds, institutional investors, market makers and the like. All these institutions make up what we call the interbank market.

Here, Smart Money can exert influence over the Forex market, pushing prices a bit further to absorb whatever liquidity is needed so they can get the volume they need.

For example, pushing the price past a key level to cause retail traders to hit stop loss. At this time, retail traders who are in a buying position must change to a selling position to be able to close the order. And this creates a chain stop loss reaction (due to supply and demand imbalance) that helps these institutions liquidate the large trading volume they desire.

Let me explain further: When you place a trade order, you are basically buying one currency and selling the other at the same time. For example, when you place a Buy EURUSD pair, you are buying Euros and selling USD. On the contrary, when Selling means selling Euro and buying USD.

Because we are buying and selling short, when the price hits the stop loss, you need to close the buy order for the EURUSD pair (buy EUR, sell USD). At this time, this amount of EUR sold needs someone to buy it back to close the order, but because many people also stop loss similarly, the larger amount of EUR sold causes more supply than demand, causing the EURUSD exchange rate to decrease further, continuing to hit the stop loss of those people. Leaving the stoploss a little further creates a chain reaction.

This will cause strong price shocks through previous key level areas (strong supply and demand), which we often call stophunting or gap jumping.

This phenomenon only stops when Smart Money takes advantage of its large volume of liquidity to absorb all the previous imbalance, causing the price to tend to push back. At this time, they will let retail traders continue to push up the price.

We understand that this does not mean they can corner the Forex market but they understand the psychology of the market and use their large trading volumes to move the market moving retail traders in their direction. they wish.

For the above reasons, SMC believes that you must trade in the direction of Smart Money to follow market makers to be successful in this market.

Smart Money Concept is a trading method based on cash flow analysis from Smart Money, tracing transactions that Smart Money lines leave on the market by analyzing and having a transaction plan to follow these Smart Money lines.

Through the words I explained above, many of you will certainly be excited and think that this is a great method. Want to learn immediately. Especially when looking at orders with very high RR rates.

Smart Money Concept can gain a deeper understanding of the market and make candles more soulful and attractive when interpreted from this perspective. Drawing Key level and Stoploss areas more accurately helps optimize high RR rates.

Especially, it explains many cases that my old perspective could not explain.

My perspective on Market Makers and SMC

However, to reduce everyone's expectations right now to avoid having too high expectations, there will be many disappointments when there are no immediate results. So I'll share a few more points for everyone to ponder.

What explains the market makers that most Traders are doing is unifying all the funds, central banks, market makers into one block and confronting retail traders (Retail Traders).

But this is not entirely reasonable because sharks also have many types of sharks and they also bite each other to gain profits, whether they are funds or banks. That's why there are loss funds, profit funds, and bankrupt banks.

In particular, the Forex market has the valuation of the national currency and economy, so you cannot expect the Bank of England to join hands with the US to make the USD change its exchange rate to destroy retail traders.

Many people also think that Market Makers understand market psychology, which may also lie in the fact that they have statistics from trading floors and know where traders place a lot of orders and where to stop losses. This is not necessarily unfounded. I think there will definitely be these statistics for Market Makers to analyze.

However, in my opinion, at any time in the market, there are people who trade in many different ways, methods, and time frames. Even like I used to use bots, EA in the past did not enter orders based on key level or preset sl or tp anymore. And there are still many people who enter orders without even placing SL or TP. So this statistical information is not all.

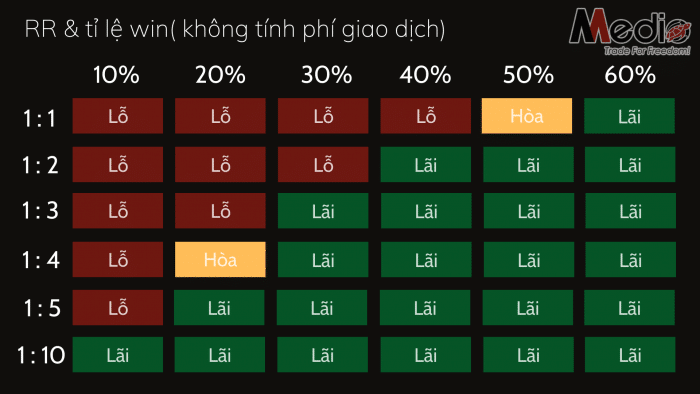

When you trade Smart Money Concept, you will get a high RR rate. But you need to accept that there may be more stop losses and have to manage your psychology very well to go through these stop loss orders.

If you can manage this, then with a high RR ratio, even if you have a lower win rate, you will still have good profits. SMC helps you have a good RR ratio so you can endure more sl times. However, when sl is small you will also be affected by cases of slippage or spread expansion.

I say this not to discredit the method or to discourage people from trading and lose confidence in the market. But so that everyone understands the importance of managing their own capital and trading rules. Phuong will play a role in helping us increase the probability of winning higher than other traders without knowledge, but it is not always correct.

As I have shared many times before, the most important thing is that you manage risk and probability very well in the financial market to bring success. Applying a disciplined approach to entering orders, increasing profits, closing a portion, etc. will help you get a high RR ratio and this will bring you profits regularly.

You can see the statistics table below to know whether you will make a profit or a loss with the win rate

You can use the table above along with your backtest to choose a suitable RR ratio and expected profit for yourself!

How to apply Smart Money Concept when trading.

Everyone knows that Price Action is a trading method that does not use indicators, so Price Action trading is very broad and has many methods. Personally, my definition is that Smart Money Concept is also a method according to Price Action.

But the Smart Money Concept will also be very broad, including many other methods that just need to be explained, following the Smart Money trace such as: Wyckoff, Order Block, Supply and Demand, Liquidity, Imbalance, other models, candlestick patterns, etc.

If you have studied many different methods, you will see that the methods all have some overlap with each other. At the same time, they refer to the same thing but have different terms such as stophunt, fake break, spring. In Wyckoff, taking liquidity in SMC all refer to the phenomenon of price breaking through previous keylevel areas before changing direction.

Even Wyckoff's model looks quite complicated with many cycles, but if you have a good grasp of Market Structure, you can see it easier than remembering a complex model,...

So I think the best way is to unify the concepts, choose what is simple and brings the highest efficiency in each method. True to the principle of minimalism.

How I am using SMC

I have consulted and am applying a small part of SMC, Order block, to optimize order placement and SL placement to help increase the RR rate, which I will make a video to share about it. And now I'm just taking that part to improve myself.

But when the same phenomenon occurs, each individual will have a different way of thinking. I respect this very much because it is the foundation of development, so I will stand in a neutral position and list a few main things of SMC that may overlap or explain my shortcomings.

If you feel that you are doing well then ignore it, if there are any shortcomings then you can research further.

- Order Block: change the way of drawing Key Level areas more accurately, optimizing the RR rate.

- Imbalance, Liquidity: Explain the path of price when price returns to Keylevel areas, reducing stophunt

- Break Of Structure This is a different way of drawing than the way I draw. I don't know if it's better or not. I still use my method because it works well for me, so each person makes their own decision.

That's in the Forex market, but with the Crypto market, I tested and found that only on large frames does the correct rate increase. As for the small frames, the candle whiskers are quite long, so they need a lot of time to test.

This is the opening article of this section. Gradually, I will update more as I progress over time as I get better and find knowledge that is highly effective. And always remember that the best method is the one that best suits your perspective. Just choose and take what you need.

Terminology in Smart Money Concept for everyone to follow when learning:

BOS : Break Of Structure: Break the structure.

Liquidity: Liquidity.

IMB : Imbalance – Imbalance of Supply and Demand

OB : Order Block – Refers to the areas where Smart Money enters orders

Liquidity Grab: Get liquidity.

Liquidity Pool: where there is a lot of liquidity, which Smart Money uses to absorb liquidity.

BB(Bigboy), MM(Market Makers): Market Makers or Sharks

Thank you for sharing more ways to optimize entry points! I hope you will soon release a video about your perspective and how to use order blocks. Many thanks!!!

Each method has its own advantages. So whoever is proficient in any method and is still making steady profits should follow it and tweak it every day. With the OB block trading method, it is probably the method that optimizes the entry point and SL is quite short, the RR ratio is probably the highest among other methods. Another advantage of this method is knowing how the sharks operate and avoiding trading at the kylevels (tops and bottoms) that the sharks intentionally create to trick investors into placing orders early. But certainly every method has disadvantages: for the SMC method, the biggest disadvantage is missing the deal, it really often misses the deal. The problem is that SL is often as people say because it is too short. It is both right and wrong because each person has a different view of the market structure, so the way of trading with the OB block is also different, leading to different results. To trade with the OB block, the most important thing is to be able to read the price structure (there is no standard for the structure, so it depends on each person's perception based on experience. Don't look at the tiny sl order that they draw and show online, it will be very difficult to have the same bet because in fact, in that OB block, they can't know exactly whether it will reach there or not? So they usually place a higher order and a further sl to avoid missing the bet.

That's right. Each method will have its own advantages. Each person just needs to take what suits them and gives stable profits.

I think if you are sure about the order and the probability of winning is high, then you should set the limit, SL long or short depending on the time frame (m5 15pip, m15 20p, h1 20-25pip). If there is a Stophunt or SMC, then continue to place the order. I think it can still compensate for the previous Stophunt order, right?

Personally, I am also new to the market, but I will take an example, Timeframe m5 pair GU, at 3pm on 11/2, I was 1stophunted but realized the situation was similar (example 3 / video secret medio) so I still entered the order and succeeded. Not to show off the order but that is my perspective. Thanks bro Medio

Great, I just heard about this a few days ago and now you mentioned it. I hope you will have another article or video about this.

Still like Medio's pp and still watch old videos to remind myself when trading even though I haven't made any profit yet :))

When will you make a video about smart money in detail?

I knew this article was right when I was starting.

Can you please provide more documents or anything else that follows this post?

Thanks a lot

I want to learn Medio's pp, what should I do? I'm also struggling to find a pp that suits me but haven't found one yet.

pp PA + adding OB seems to be too optimal for pp Medio?

Thanks. And I have learned about smc but I see that it also asks about keylvqt or at most gets stophunted, so if I trade according to keylv and add OB block, it will be a better PP than smc. That is my feeling. Or is my level not up to feel SMC yet?

What is CHOCH admin?